This calculator allows you to enter your annual deposit. Just like numerous things in life theres never one ideal response.

Roth Ira For Kids Fidelity

Roth Ira For Kids Fidelity

Im additionally mosting likely to make a referral on how to decide which of these three techniques is finest for you.

Roth ira calculator fidelity. One of Fidelitys solid mutual funds is the Fidelity 500 Index Fund NASDAQMUTFUND. IRA Contribution Calculator Answer a few questions in the IRA Contribution Calculator to find out whether a Roth or traditional IRA might be right for you based on how much youre eligible to contribute and how much you might be able to deduct on your taxes. By answering a few questions and picking an investment strategy account holders provide their advisors with the necessary information to map out.

The calculator will show you the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement to the balance you would have if you used a. Maintaining a Roth IRA does not require financial advisory services but Fidelity does offer several managed account solutions to handle investments and retirement. The calculator shows the minimum amount that must be taken out of the account and when withdrawals must begin.

Earnings from a Roth IRA can be withdrawn federally tax-free and penalty-free provided that its been 5 years since your first contribution. When investing in Fidelity Roth IRA mutual funds are obviously the best investment option to take. Fidelity Go is the basic option.

For calculations or more information concerning other types of IRAs please visit our IRA Calculator. Roth IRAs have income limits. So I desire you to be as informed as possible to ensure that.

You need to do the step 4 above since Fidelity doesnt support automatic rollover of after-tax contribution to Roth IRA account. Due to the fact that the very best investment for you might not be the very best investment for another person. 13 Zeilen Determine your estimated required minimum distribution from an Inherited IRA.

Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now but withdraw the funds tax-free in retirement. It is mainly intended for use by US. The calculator also shows when the account will be completely withdrawn.

There are usually more fund options to invest in a Roth IRA account than in a Roth 401K account. Decide if you want to manage the investments in your IRA or have us do it for you. The Roth IRA can provide truly tax-free growth.

You can use our IRA Contribution Calculator or our Roth vs. Hypothetical pretax return on investments. You will pay taxes on your earnings and contributions when you make withdrawals.

Creating a Roth IRA can make a big difference in your retirement savings. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional rollover SEP andor SIMPLE IRAs into a Roth IRA but it is intended solely for educational purposes it is not designed to provide tax advice and the list of factors included in the calculation is not exhaustive. This is a fixed rate calculator that calculates the balances of Roth IRA savings and compares them with regular taxable savings.

Below is an example of how the reduced limit is calculated for someone who is filing as single head of household or married and filing separately and you didnt live with your spouse at any time. A low-cost digital advisor for simple account management. This example is for illustrative purposes only and does not represent the.

Creating a Roth IRA can make a big difference in your retirement savings. A minimum required distribution calculator helps Fidelity clients figure if and when withdrawals from an IRA must be taken according to IRS guidelines. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from taxes under current tax laws.

If you want to do this in step 2 above instead of Roth 401K you have to call Fidelity to have them move after-tax contribution money in your 401K to a Roth IRA account. Because this is a Roth IRA your contribution limit is after taxes and your effective contribution limit is higher than a Traditional IRA. Hypothetical after-tax return on investments.

Its free to sign up and bid on jobs. Traditional IRA comparison page to see what option might be right for you. This illustration assumes the 3 individuals are eligible for tax-deductible IRA contributions and Roth IRA contributions.

These tools include the Fidelity Spire app and Retirement Score Calculator. Expected marginal tax rate in retirement. Search for jobs related to Roth ira calculator fidelity or hire on the worlds largest freelancing marketplace with 19m jobs.

Answer a few questions in the IRA Contribution Calculator to find out whether a Roth or traditional IRA might be right for you based on how much youre eligible to contribute and how much you might be able to deduct on your taxes. To better understand your eligibility use our IRA Contribution Calculator. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from taxes under current tax laws.

Roth IRA Calculator Fidelity. As your income increases the amount you can contribute gradually decreases to zero. Note that tax rates may not remain constant for 30 years.

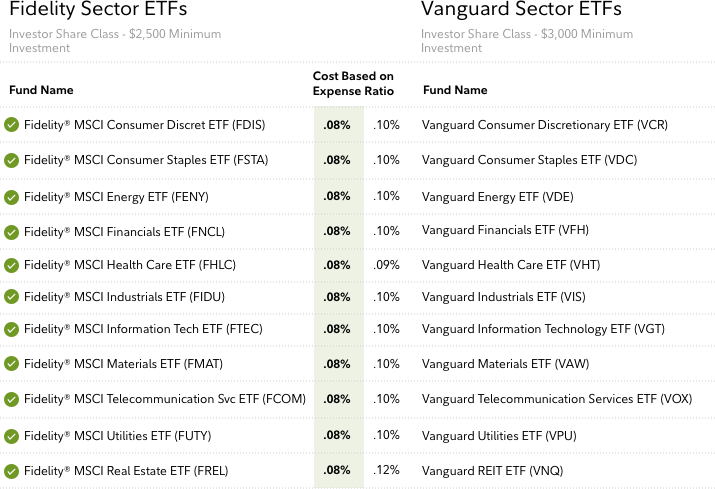

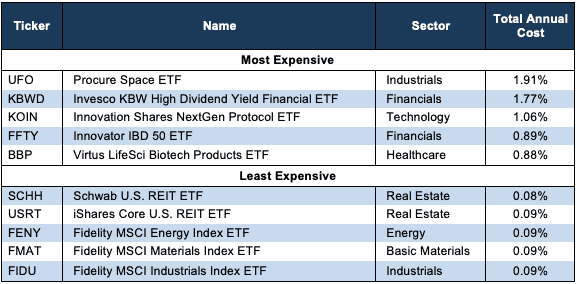

FUSEX which has one of the lowest expense ratios of 0010. How much money can you contribute to your IRA. The Roth IRA can provide truly tax-free growth.

Netbenefits Login Page Fidelity

Netbenefits Login Page Fidelity