In addition the 065 per contract fee for Fidelity Rewards customers is waived for an unlimited number of contracts per trade. For example if you sign up for a managed account your 401 k plan might provide such information as your balance your income and whether your company has.

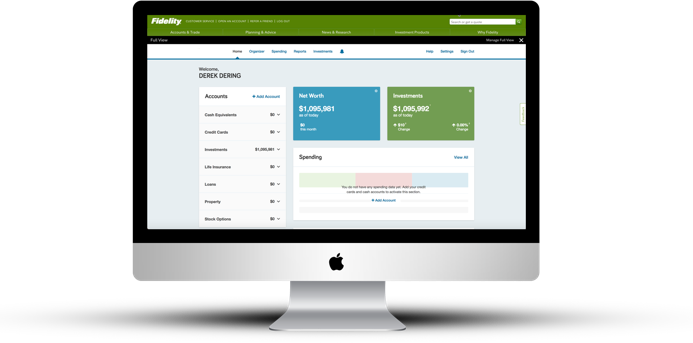

Full View All Your Online Financial Information In One Place Fidelity

Full View All Your Online Financial Information In One Place Fidelity

We draw on 70 years of successfully managing equity investments to.

Fidelity 401k managed account. If you have any questions about the account transfer process Fidelity has specialists who are ready to help. Fidelity Interactive Content Services LLC FICS is a Fidelity company established to present users with objective news information data and guidance on personal finance topics drawn from a diverse collection of sources including affiliated and non-affiliated financial services publications and FICS-created content. Fidelity started making its managed account available on alternate record-keeping platforms.

Depending on the service provider and how much you have to invest a managed account can cost you 015 to 07 a year. It is currently invested in many mutual funds bonds and some index funds. Just give them a call at 18003433548.

On-line chat is also available. Our equity SMAs pursue better outcomes through Fidelitys. Fidelity expands 401k managed account business.

Please contact an investment professional at 800-343-3548 for additional details. Content selected and published by FICS drawn from affiliated Fidelity. Integrating Fidelitys deep equity expertise and skill managing institutional-quality portfolios Fidelity Advisor Separately Managed Accounts are compelling options for clients seeking capital appreciation.

Contact Fidelity regarding your account by phone or online. The Fidelity 401k BrokerageLink Fidelitys version of a self-directed 401k within a managed 401k account is one of the best brokerage windows offered on the market today. For our total assets Fidelity needed enough assets to be assigned to the managed accounts so that the annual fee paid quarterly equaled 5000 per year at the built in rate.

Fidelitys Managed Retirement Funds. Note that an Options Regulatory Fee from. Fidelity Personalized Planning Advice is not currently designed for clients who are retired within three years of retirement or in need of retirement income planning.

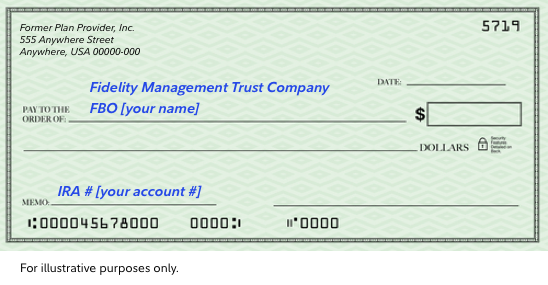

A Roth 401 k plan is moved into a Roth IRA where distributions are tax free because the contributions have already been taxed. Interested in opening an account. By Editorial Staff Thu May 18 2017.

3 largest providers by assets. One problem when 401k account holders opt for managed accounts is getting participants to interface with the data and provide all necessary information to the account manager Scheinberg said. 7 Zeilen Help turn your investments into retirement income.

First off it is important to know that an investor can only have a BrokerageLink account if they have a company sponsored 401k account that allows for the BrokerageLink. I have an IRA at Fidelity. Gross advisory fee applicable to accounts managed through Fidelity Strategic Disciplines ranges from 020 to 049 and gross advisory fee applicable to accounts managed through Fidelity Wealth Services ranges from 050104 in each case based on a minimum investment of 2 million.

Currently I am paying Fidelity to actively manage the account. However you are entitled to place reasonable restrictions on the management of your account. This waiver is limited to 100 trades per year for the Gold tier and 250 trades per year for the Platinum tier.

Fidelity Personalized Planning Advice clients must invest and maintain a minimum of 25000 in the aggregate and accounts will not be invested according to an investment strategy until an account has a balance of at least 10. In addition to the cost ratio I am paying on the various mutual funds I am also paying a quarterly fee to Fidelity that is based on the average balance of the account something like. The contract fee is waived for all trades for the Platinum Plus Tier.

So if you expect to retire in the year 2040 you could simply purchase a 2040-target date fundset it and forget it. Fidelity waives commissions for all online options trades. Brokerage Mutual Fund and IRA Account questions.

Think of it as an automatic portfolio manager. So 5000 Assets under Management rate amount of assets that Fidelity must manage for us. Financial Engines and Fidelity respectively the No.

Innovative proven approaches to seeking capital appreciation. Approximately this asset amount was transferred from our regular accounts to new Fidelity managed accounts based on decisions. However this professional management comes at a price.

Fidelity announced this week that it will offer fiduciary managed account services to retirement plans that Fidelity is not the recordkeeper for--and where it will compete with managed account providers like Financial Engines and Morningstar. It is where I have rolled old 401k plans into. By enrolling in a managed account service like Fidelity Go you turn the day-to-day management of your investments over to a team of investment professionals.

Fidelity Investments Review Pros Cons And Who Should Set Up An Account

401k Rollover Options Fidelity

401k Rollover Options Fidelity

Fidelity Solo 401k Brokerage Account From My Solo 401k

Fidelity Solo 401k Brokerage Account From My Solo 401k

Fidelity Adds More Financial Planning To Its 401 K Managed Accounts Investmentnews

Fidelity Adds More Financial Planning To Its 401 K Managed Accounts Investmentnews

The Best Fidelity Funds For 401 K Retirement Savers Kiplinger

The Best Fidelity Funds For 401 K Retirement Savers Kiplinger

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

401k To Rollover Ira New Account Steps Fidelity

401k To Rollover Ira New Account Steps Fidelity

Fidelity 401k Adds Layers To Its Managed Account Offering Employee Benefit News

Fidelity 401k Adds Layers To Its Managed Account Offering Employee Benefit News

Fidelity Go Review Smartasset Com

Fidelity Go Review Smartasset Com

Fidelity 401k Brokerage Link 2021

Fidelity 401k Brokerage Link 2021

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Ramps Up 401 K Managed Account Distribution Investmentnews

Fidelity Ramps Up 401 K Managed Account Distribution Investmentnews

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Investments Review Self Directed Trading Managed Options

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.