A Great Card for Rewards Maximizers. - variable APR based on your creditworthiness.

Citi Expedia Rewards Card 50 10 000 Points Bonuses

Citi Expedia Rewards Card 50 10 000 Points Bonuses

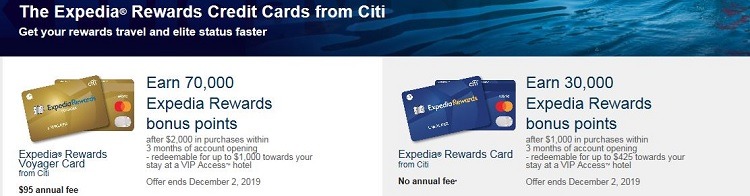

To bring you the Expedia Rewards Card a Citi Expedia credit card that earns points to redeem toward travel rewards.

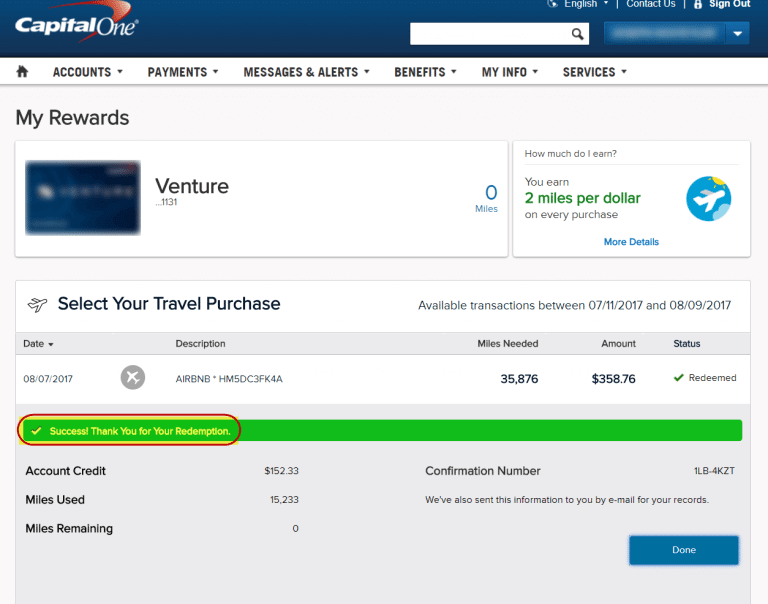

Citi expedia credit card. The Expedia Rewards Voyager Card from Citi is offering 70000 Expedia Rewards bonus points after you spend 2000 in purchases in the first three months. Expedia Card from Citi Review Application Link. Earn 2 cash back.

Find out all about the Expedia Card from Citi - well provide you with the latest information and tell you everything you need to know to find your perfect card. Expired Increased Citi Expedia Credit Card Offers Up To 70000 Points Last Day. Thats on top of the 2 points per dollar you earn as an Expedia rewards member.

The ongoing APR is 1499 -. The Expedia Voyager Card from Citi has the potential to be one of the best travel credit cards in the hands of the right user. Enjoy a low Intro APR for months on balance transfers.

Once you click apply for this card you will be directed to the issuers website where you may review the terms and conditions of the card before applying. Thats because the card allows cardholders to earn a high number of points on Expedia purchases and a decent number of points on restaurant and entertainment expenses. While the Expedia Card from Citi doesnt offer the best sign-up bonus weve ever seen its impressive when you consider the cards 0 annual fee.

Maximize your Expedia Rewards points with Citis premium card for Expedia users. With your Expedia Rewards Voyager Card from Citi you will receive 100 Annual Air Travel Fee Credit each year of card membership for use on airline incidental fees including qualified airlines for baggage fees inflight Wi-Fi or application fees for either the Global Entry or TSA Pre programs. Satisfy your impulse to travel with the Expedia Voyager Card from Citi a travel credit card that lets you earn points to redeem on premium travel rewards.

Citi partnered with Expedia Inc. After that the variable APR will be based on your creditworthiness1. To bring you premium travel rewards with an optimal Expedia credit card experience.

Youll earn 4 points per dollar spent with Expedia. Also enjoy Expedia Rewards Gold Status for each year of card membership. With your Expedia Rewards Voyager Card from Citi you will receive 100 Annual Air Travel Fee Credit each year of card membership for use on airline incidental fees including qualified airlines for baggage fees inflight Wi-Fi or application fees for either the Global Entry or TSA Pre programs.

1399 2199 variable APR based on your creditworthiness. According to Expedia that bonus is worth up to 1000 when you redeem for a VIP Access hotel. As with many other travel rewards cards the Expedia Card from Citi offers cardholders the chance to boost their rewards earnings right off the bat.

Intro APR for months on balance transfers. There is now a public link that will work youll still need to log into your account before applying. Citi partnered with Expedia Inc.

1 when you buy 1 as you pay. Expedia Rewards Voyager Credit Card from Citi Expedia Rewards Voyager Credit Card from Citi. Learn more about reward credit cards.

The great thing about the Expedia Card from Citi is that it earns you 3 Expedia bonus points per 1 spent on eligible Expedia purchases 1 Expedia point per 1 on all other purchases. Expedia Card from Citi. Bonus back to 50k pts.

The ongoing interest rate on both the Expedia Rewards Card from Citi and the Expedia Rewards Voyager Card from Citi can be quite high. December 2 2019 1410. Enjoy Silver status each year of Expedia card membership and a full range of other Citi card benefits.

For complete information see the terms and conditions on the credit card issuers website. Earn Expedia Rewards bonus points after in purchases within months of account opening.

:max_bytes(150000):strip_icc()/lightstream-3510982a0dce45f89b48b246ce3a5778.png)