Coverage can be bound through the insurance company issuing the policy or by the verbal or written commitment called a binder of an authorized. Where a taxable person has concluded an agreement with a life assurance company such as the agreement at issue between ACMC and UL under which that taxable person undertakes for a certain remuneration and with the aid of qualified personnel who are expert in the insurance field most of the actual activities related to insurance -.

Achieving The Digital Quote Bind Journey In Insurance Softelligence

Achieving The Digital Quote Bind Journey In Insurance Softelligence

Being licensed bonded and insured is a way to make your company more trustworthy and reliable.

Bind insurance meaning. The insurance binder is a proof of insurance you can use until you receive your actual policy. Administrative services for self-funded group health plans are provided by Bind Benefits Inc and in CA by Bind Benefits Administrators Services. Binder a legal agreement issued by either an agent or an insurer to provide temporary evidence of insurance until a policy can be issued.

Your insurance coverage can be bound one of two ways. Bond insurance also known as financial guaranty insurance is a type of insurance whereby an insurance company guarantees scheduled payments of interest and principal on a bond or other security in the event of a payment default by the issuer of the bond or security. When you say that you are licensed bonded.

Once the agent has binding authority they are legally allowed to sell policies on the insurers behalf. For fully insured plans insurance coverage provided by or through UnitedHealthcare Life Insurance Company MN and All Savers Insurance Company for FL GA NC OH UT and VA. A binder is an oral or verbal agreement of coverage issued by an agent or insurance company before a policy has been officially issued.

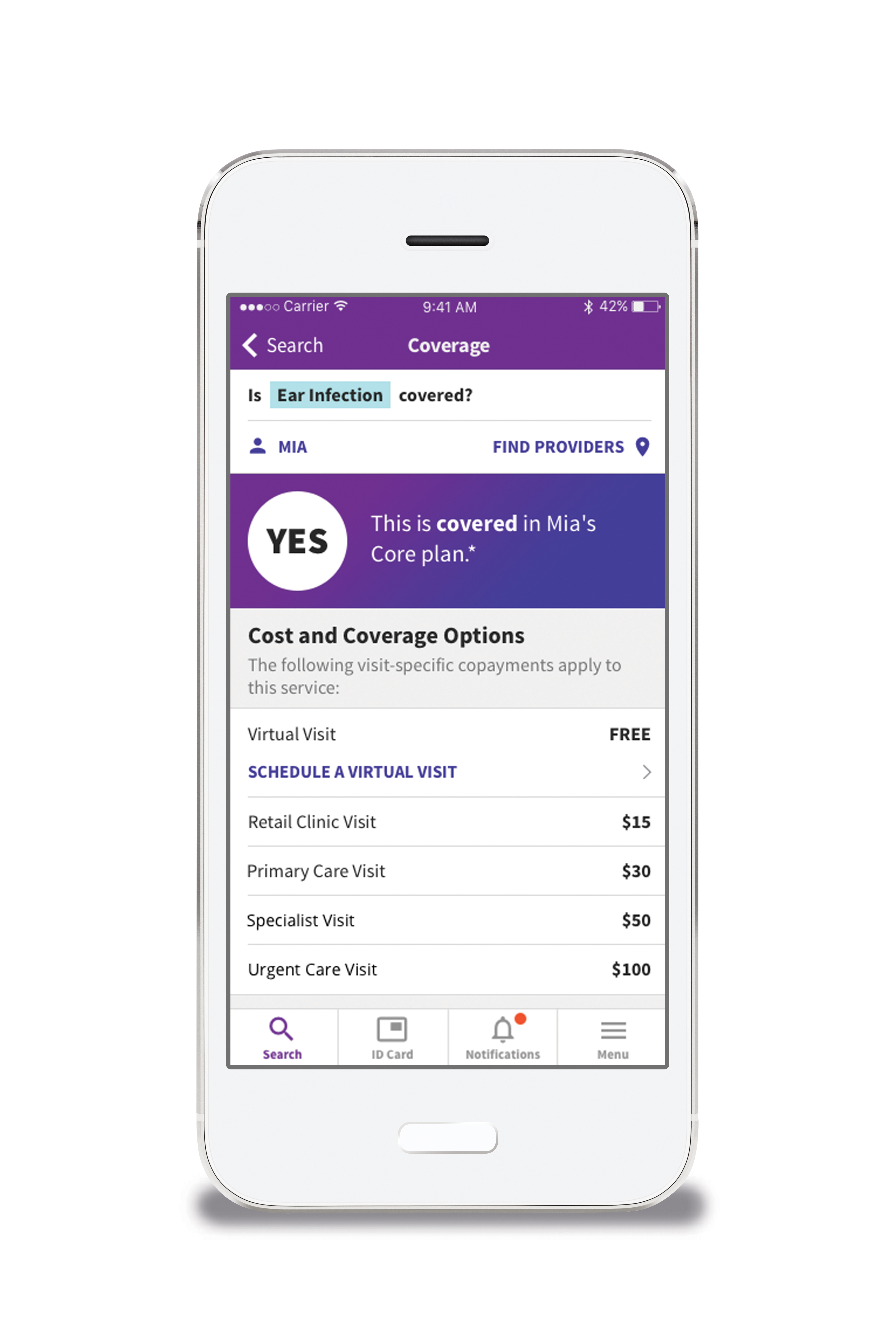

Bind is a healthcare startup aimed at providing on-demand health insurance for consumers to pay for the coverage plan they want. It is a form of credit enhancement that generally results in the rating of the insured security being the higher of i the. The definition of an insurance binder is a temporary insurance contract that offers the binder holder fully effective insurance coverage while they wait for the formal issuance or in some cases rejection of an insurance policy.

Bind has been utilized by several business organizations. There are two main differences between insurance agents and brokers. In property and liability insurance the agent customarily is given the authority to accept offers from prospective insureds without consulting the insurer.

Purpose A binder allows a customer to obtain insurance coverage without waiting for an insurance company to process. To keep your costs low and revenues high you need to be able to quote and bind policies quickly and effectively. Bonded and insured means your company has the proper insurance and has purchased a surety bond though consumers also want to see that your employees are licensed contractors.

Agents also receive appointments to represent one or more insurance companies but brokers do not. When your agent binds a policy it means that he or she as a representative of the insurance company confirms that coverage is in place. Being bonded is not insurance.

Administrative services may be provided by Bind Benefits Inc and United HealthCare Services Inc and its affiliates for insurance. Agents can complete insurance sales bind coverage while brokers cannot. Requirements to become bonded vary by state and.

Were here to help. Insured a little. Lets break down being bonded vs.

Agents represent insurers while brokers represent consumers. What Does It Mean To Be Bonded and Insured. Binders should contain definite time limits should be in writing and should clearly designate the insurer with which the risk is bound.

Bond insurance is a type of insurance purchased by a bond issuer to guarantee the repayment of the principal and all associated scheduled interest payments to the bondholders in the. The cost to get bonded and insured. Insurance binders are contracts of temporary insurance pending the issuance of a formal policy or proper rejection of the application by the insurer.

An appointment is a contract an agent and insurer sign that outlines the products the agent can. An insurance binder may be issued for a limited time. A binding authority is an agreement in which an insurer gives full authority to an agent typically an insurance broker to act on their behalf for the purpose of underwriting.

In this article well cover. Different types of bonds. In such cases the agent is said to bind.

It can be a little confusing when the terms bond insurance surety bond insurance are being used but being bonded is still not the same as being insured. The difference between being bonded and being insured. Does my business need to be bonded and insured.

The difference between being bonded and insured. If you find yourself going wondering what those terms mean youre in good company. Being bonded is more like credit where the risk with the bond lies with the principle meaning the person buying the bond not with the insurance company.

With better data on your leads you can increase underwriting efficiencies and quote to bind ratios providing more accurate policies and a better customer experience.