Until you turn 70 of course -. The most your spouse can receive on your work record is 50 percent of your primary insurance amount which is the monthly benefit you are entitled to at full retirement age.

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Based on our statements from 162020 Ill have about 2200 at 67 2750 at 70 and 1550 at 62 and survivor benefits for her at FRA of 2250.

How much social security will i get at age 70. Those whose Full Retirement Age is 65 are already that age or older. Instead it will estimate your earnings based on information you provide. The maximum benefit for the spouse is 50.

How much will my payments be if I wait until age 70. Multiply that by 12 to get 46740 in maximum annual benefits. Up until age 70 your Social Security benefits accumulate delayed retirement credits.

If Ritas payment amount is 54989 per month her increased monthly payment would be 74785. If you delay until age 70 it will be 124 percent of your expected benefit or 1240 a month. Delaying past age 70 will not increase your benefit however.

Financial advisors say its typically a smart move. The maximum possible Social Security benefit for someone who retires at. In the year the person turns full retirement age the earnings limit becomes 41880 and for every 3 earned thereafter benefits reduce by 1 until full retirement age is reached.

However if you nevertheless continue to work and pay Social Security payroll taxes between age 66 and 70 your monthly benefit at age 70 will be. If she decides to delay receiving the Old Age Security pension for the maximum deferral period of 60 months her monthly amount will increase by 36 at age 70 06 x 60 months. Yes there is a limit to how much you can receive in Social Security benefits.

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is 3895 for someone who files at age 70. Claiming Social Security at age 65. 1 1959 who has averaged a 50000 annual income would get a monthly benefit of 1264 if they file for Social Security at 62 1785 at full retirement age in this case 66 years and 10 months or 2237 at 70.

Benefit estimates depend on your date of birth and on your earnings history. Your benefits payment goes up 8 for every year after full retirement age that you delay collecting payments. For 2021 its 3895month for those who retire at age 70 up from 3790month in 2020.

Income Tax on Social Security After Age 70 Under the Federal Insurance Contributions Act your employer takes Social Security taxes out of your paycheck. Social Security Quick Calculator. So benefit estimates made by the Quick Calculator are rough.

As of 2015 for any year prior to full retirement age the earnings limit is 15720 according to the SSA. That comes out to 2880 more each year. Heres how to decide if it will work for you.

For example the AARP calculator estimates that a person born on Jan. If you defer your Social Security benefits until the age of 70 youll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months according to the Social Security Administration. As a result there is a significant benefit to deferring Social Security.

For security the Quick Calculator does not access your earnings record. The maximum Social Security benefit changes each year. For every 2 earned after that the benefit reduces by 1.

10 rader Percentages are approximate due to rounding. Fewer than one in 10 Americans wait until age 70 to claim Social Security. The average Social Security benefit was 1543 per month in January 2021.

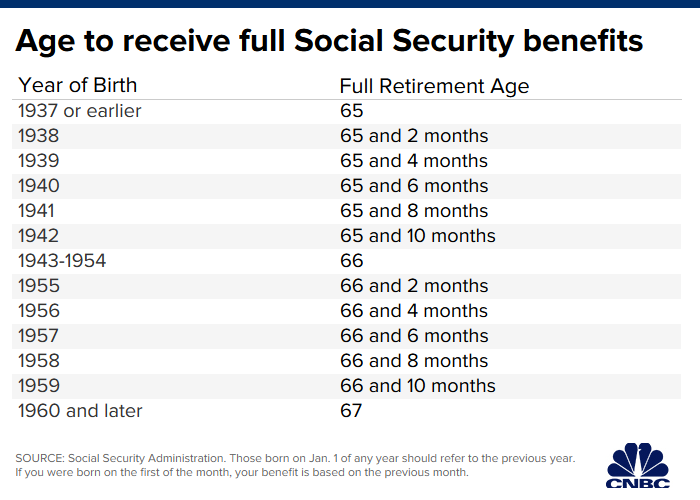

If you wait until you are 70 to take your Social Security benefit you will receive monthly payments that are 32 higher than the benefits you would have received at age 66 which is the. If youre self-employed you pay self-employment tax instead adding it to your income tax payments. Full retirement age is currently 66 and 2 months and is gradually rising to 67 for people born in 1960 or later.