Charles Schwab margin loans. Certificates of Deposit CDs carry an early withdrawal penalty equal to 90 days interest for all terms and balance tiers.

Investing With Margin Is It Risky Or Genius

Investing With Margin Is It Risky Or Genius

The APR on your home equity line of credit is variable based upon the Wall Street Journal Prime Rate plus a margin.

Schwab margin interest rate. Charles Schwab and. Such account features could influence customers ratings of their brokers for margin trading along with the interest rate charged. Like any other borrowing product you must repay your margin debit balance along with interest regardless of the underlying value of any positions you might have secured with margin.

As of March 16 2020 the APR for a primary residence is 399 standalone rate 300 piggyback rate. The maximum APR that can apply is 18 or the maximum amount permitted by state law whichever is less. The initial variable Annual Percentage Rate on the Pledged Asset Line based on the loan value of the collateral pledged at origination is the sum.

Schwabs margin trading is expensive but Schwab makes up for it. The Annual Percentage Yield assumes interest remains on deposit until maturity. Margin rate x Principal 360 x Number of days Total interest Lets use 2020s margin rates at Schwab for our example.

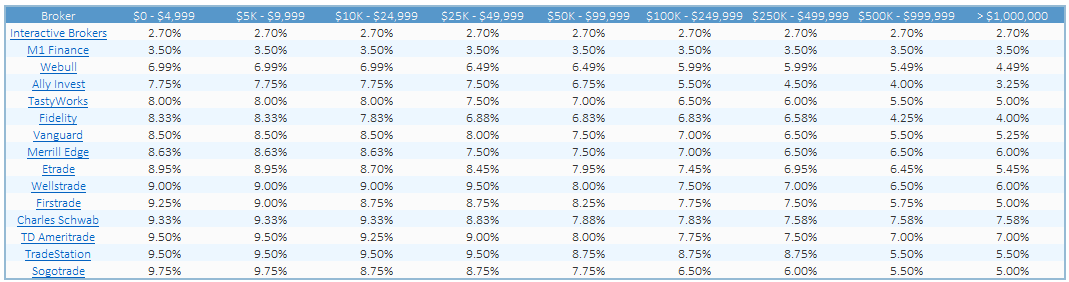

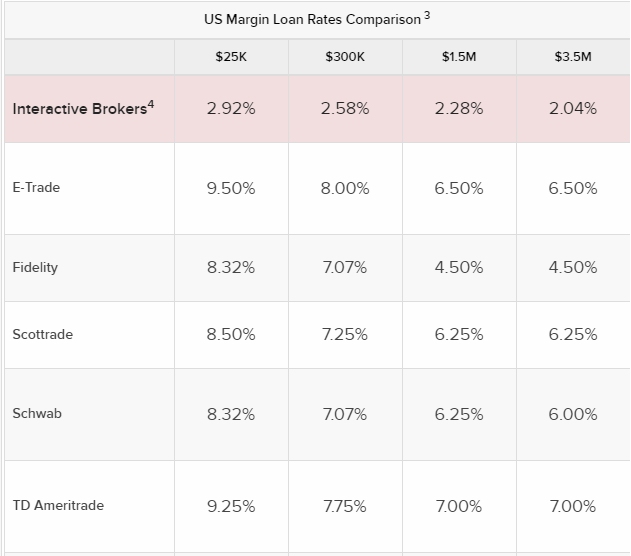

If we borrowed 10000 wed fall into the highest margin rate bracket. In 2015 when the Federal Funds rates averaged less than 025 Schwab generated an average net interest margin of 160. Compare the best margin accounts interest rates at Etrade Merrill Edge Interactive Brokers Charles Schwab TradeStation TD Ameritrade Fidelity Investments Firstrade and Ally Invest.

Schwab Bank reserves the right to change any part of the interest rate after the Pledged Asset Line is established including the LIBOR reference rate interest rate spread or post-demand spread. Competitor rates and offers subject to change without notice. Calculate how much your broker will charge for a loan Ally Invest TD Ameritrade Robinhood Vanguard Wells Fargo IB Fidelity Merrill Edge Etrade and Charles Schwab.

Margin is a flexible lending solution available to Schwab clients looking to purchase additional securities or meet short-term borrowing needs. Margin loan rates and credit interest rates are subject to change without. For loans up to 2499999 Schwab charges their base rate of 65 with an added 1825.

Margin is a feature that may be available on your brokerage account and if it is you can start to borrow with as little as 2000 in eligible securities at competitive interest rates. Compare Mortgage Interest Rates Education Investing. Here you can see information such as margin equity funds available to trade or withdraw as cash current margin balance and month-to-date margin interest owed.

As the Fed has raised. 6 rows Charles Schwab margin rates are high and start at 9575 for the most customers. 11 rows For Schwab Bank Investor Advantage Pricing IAP.

Second lien standalone or piggyback HELOCs are available with an eligible Schwab Bank first lien loan. Brokerage Margin Interest Rate Payment Calculator Free online stock brokerage margin interest rate payment calculator. Each firms information reflects the standard online margin loan rates obtained from their respective websites.

Loans are eligible for only one Investor. If your brokerage firms maintenance requirement is 30 30 of 6000 1800 you would receive a margin call for 800 in cash or 1143 of fully paid marginable securities 800 divided by 1-30 1143or some combination of the twoto make up the difference between your equity of 1000 and the required equity of 1800. The lowest margin interest rates for major brokerage firms.

The interest rate and Annual Percentage Yield APY will not change for the term of the account. Due to Schwabs competitive rates margin borrowing can be more cost-effective than other consumer lending options.

Robinhood Which Brokerage Has Lowest Margin Interest Rate Blind

Robinhood Which Brokerage Has Lowest Margin Interest Rate Blind

Charles Schwab Margin Rates 2021

Charles Schwab Margin Rates 2021

Margin Trading Which Broker Offers You The Best Rate Investor S Business Daily

Margin Trading Which Broker Offers You The Best Rate Investor S Business Daily

Interactive Brokers Interest Rate Play In A Trillion Dollar Market Nasdaq Ibkr Seeking Alpha

Interactive Brokers Interest Rate Play In A Trillion Dollar Market Nasdaq Ibkr Seeking Alpha

Https Www Schwab Com Public File P 4193744

Margin How Does It Work Charles Schwab

Margin How Does It Work Charles Schwab

Charles Schwab Margin Rates 2021

Charles Schwab Margin Rates 2021

Margin Expands Regardless Of Rate Barron S

Margin Expands Regardless Of Rate Barron S

What Are Trading Margin Rates And How Are They Calculated

What Are Trading Margin Rates And How Are They Calculated

Margin How Does It Work Charles Schwab

Margin How Does It Work Charles Schwab

Interactive Brokers Offers Low Margin Lending Rates Barron S

Interactive Brokers Offers Low Margin Lending Rates Barron S

Stock Settlement Why You Need To Understand The T 2 Timeline Charles Schwab

Stock Settlement Why You Need To Understand The T 2 Timeline Charles Schwab

What Declining Interest Rates Could Mean For You Charles Schwab Commentaries Advisor Perspectives

What Declining Interest Rates Could Mean For You Charles Schwab Commentaries Advisor Perspectives

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.