Expand your team with our flexible and reliable associates. You still get the benefit of working with a team that deeply understands the regulatory environment and requirements for mortgage origination without any of the headaches or.

Mortgage Origination Outsourcing Solutions Verity Mct National We

Mortgage Origination Outsourcing Solutions Verity Mct National We

Ready to see how Mortgage Process Outsourcing can accelerate growth for you.

Mortgage origination outsourcing. We are privileged to reveal that 51 of our business related to banking comes from consumer lending and mortgage. Outsourced mortgage fulfillment is recognized for its ability to help mortgage lenders manage costs and remain competitive in the face of ever-increasing built-in expenses. Lenders benefit from a full range of mortgage products and a scalable business model without the overhead or risk.

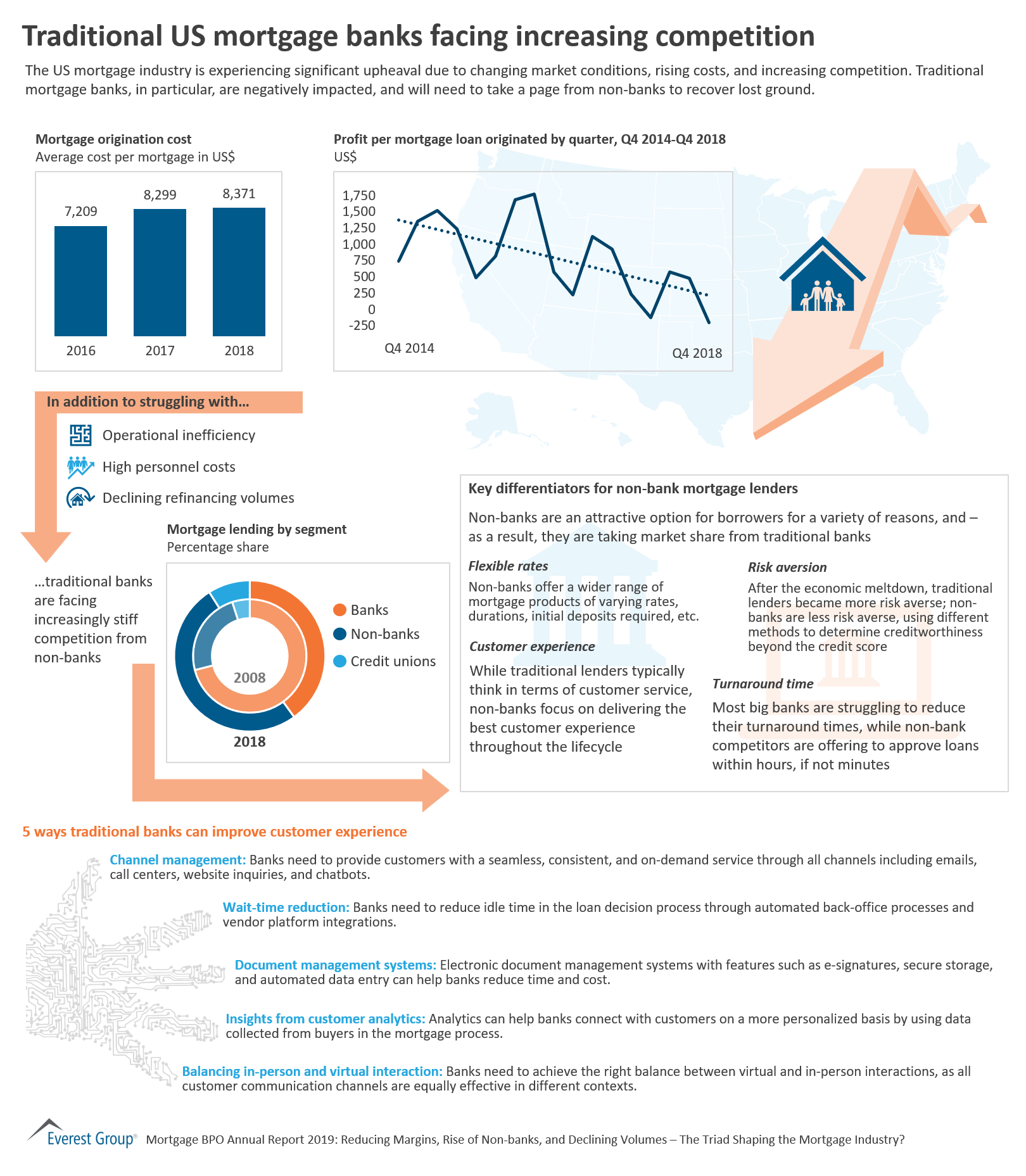

EST 2 Min Read Managing costs and creating operational efficiencies are foremost on the minds of the mortgage lenders with the ongoing pandemic creating pressure on. Originators predict more outsourcing and consolidation in 2021 By Brad Finkelstein February 05 2021 1254 pm. A mortgage company can improve streamline and reduce the cost of the process by opting for outsourcing much of the process.

IBNs outsourcing mortgage loan processing services not only does this but also offers wide-ranging services for 247. We can help you. Streamline your origination process and turn fixed costs into variable costs.

This will only lower your operational costs as it eliminates the need to hire and train more resources pay more wages or invest in more infrastructure to accommodate these new hires. We offer high quality mortgage outsourcing services and processing with fast turn-around times. Why not expand that outsourcing and related savings to other areas to supplement the process and increase loan revenues.

A third-party origination is any loan that is completely or partially originated processed underwritten packaged funded or closed by. Mortgage process outsourcing services is not an easy-going. This upswing has been fueled by rising compensation benefits technology and compliance costs putting pressure on margins and leaving originators in a tight spot.

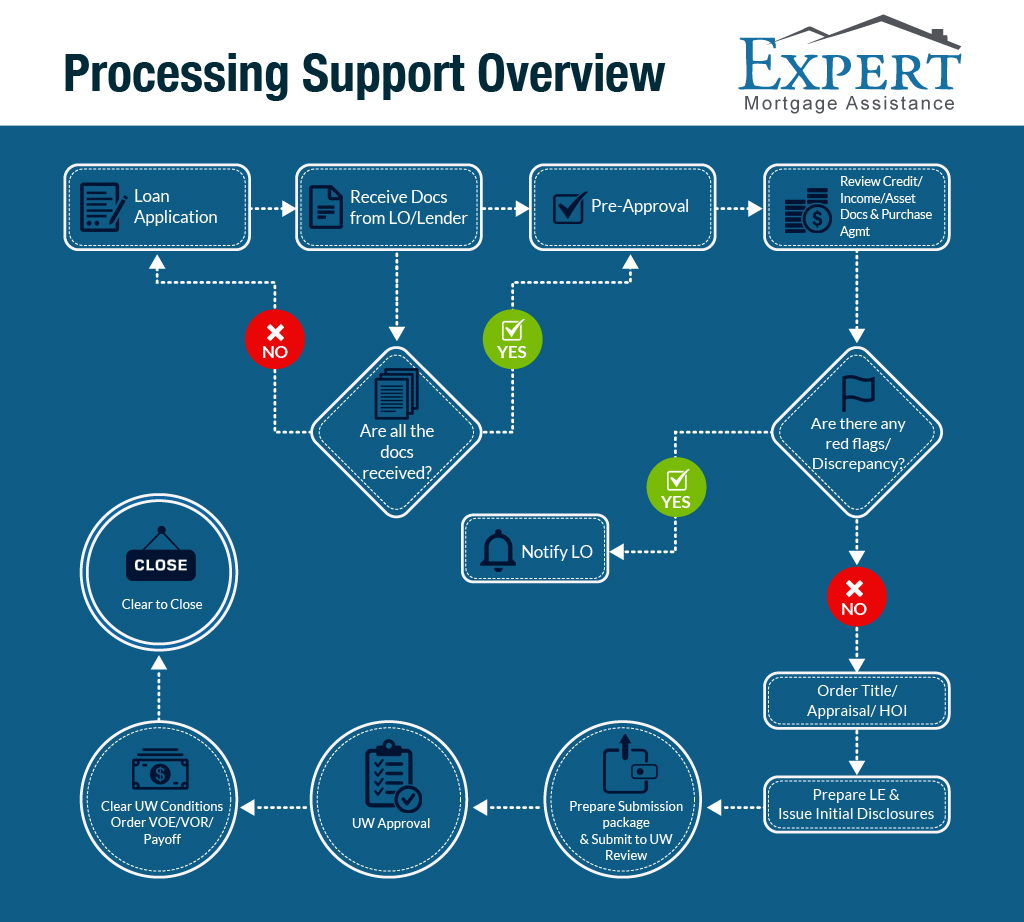

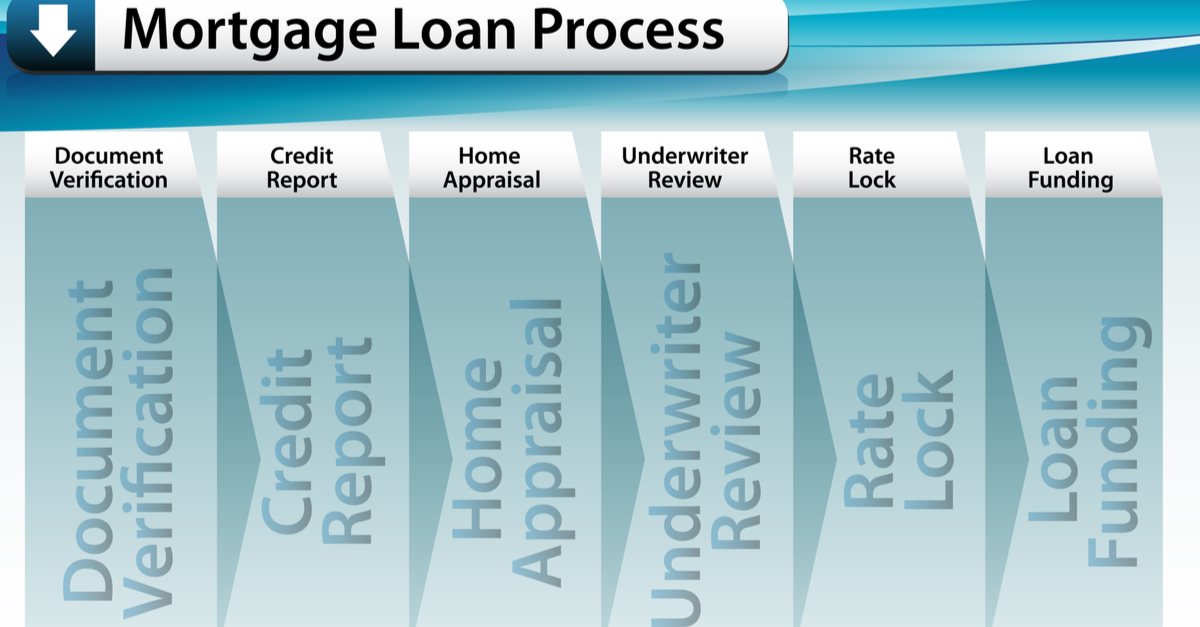

This concludes the loan origination process though each step is of equal importance and has to be followed diligently. With more than a decades experience behind our backs we offer our clients several inherent benefits such as -. Mortgage process outsourcing will help you originate more loans without needing to hire a costly permanent in-house team to handle growing business volumes.

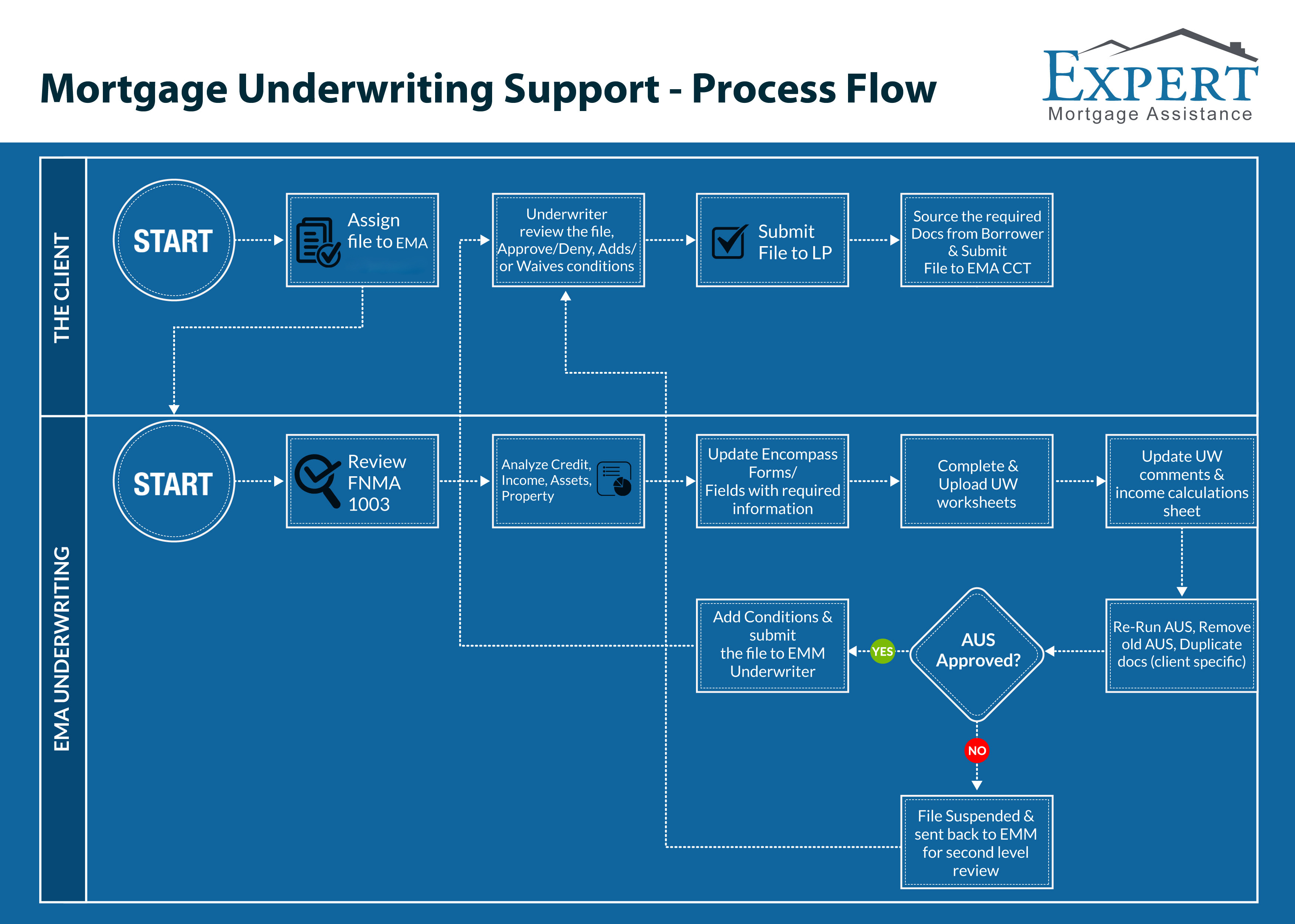

99 accuracy in reviewing all information in the loan file credit report VOE VOD property appraisal etc. To ensure quality and compliance whether the loan is originated retail or through a Broker Lenders are required to perform pre and post close loan reviews. For lenders considering non-agency loans to increase pipeline volume and drive origination growth outsourcing offers the ability to quickly activate specialty products and meet shifting market conditions.

Intelligent Automation Intelligent Automation drives down costs and improves efficiencies helping organizations achieve their strategic objectives. Affordable options to help you grow your mortgage business. Management Procedures for Third-Party Originations Third-Party Originations.

These services comprise of underwriting closing documents review loan modification and payoffs. Many forward-looking lenders are. Fill out your information and get a proposal from us within 24 hours.

Outsourcing the origination services ensures that your deadlines are met efficiently without any loss of customer service quality but it also means you do not have to expend the effort and money in having too many in-house employees. This topic contains information on the outsourcing of mortgage originations to third parties including. When using a Mortgage Broker a lender is outsourcing the loan originations.

Benefits of Outsourcing Origination Underwriting Support to Flatworld. As an Expert Mortgage Processing Company We Offer the Following Benefits By outsourcing mortgage loan process to us you get the following advantages. From attracting a younger demographic to the possible implications of GSE reform looming over the mortgage industry.

Mortgage Services Under One Roof - A streamlined loan origination system right from PoS to closing. 1000 highly trained mortgage underwriters and processors working fulltime. Save over 50 on your operating costs.

Rely Services is a top-ranked Business Process Outsourcing BPO firm that specializes in the Mortgage Industry and has made Mortgage Process Outsourcing a specialty. Our suite of mortgage solutions cover business process outsourcing for originations servicing and default management and title and closing products.

Mortgage Origination Outsourcing Solutions Verity Mct National We

Mortgage Origination Outsourcing Solutions Verity Mct National We

Mortgage Outsourcing Processing Underwriting Mortgagepro360

Originators Predict More Outsourcing And Consolidation In 2021 National Mortgage News

Originators Predict More Outsourcing And Consolidation In 2021 National Mortgage News

Mortgage Post Close Outsourcing Document Management Trailing Documents

Mortgage Outsourcing Archives Everest Group

Mortgage Outsourcing Archives Everest Group

Outsource Mortgage Loan Processing Services For Lenders Usa

Outsource Mortgage Loan Processing Services For Lenders Usa

Mortgage Underwriting Process Outsourcing Services In Usa

Mortgage Underwriting Process Outsourcing Services In Usa

Outsourcing Mortgage Operations Webinar Recap Mct

Outsourcing Mortgage Operations Webinar Recap Mct

Accenture Ranked Tops In Mortgage Business Process Outsourcing

Outsourcing Mortgage Operations Webinar Recap Mct

Outsourcing Mortgage Operations Webinar Recap Mct

With Record High Mortgage Origination Costs Can You Actually Save With Outsourced Fulfillment Promontory Mortgagepath

With Record High Mortgage Origination Costs Can You Actually Save With Outsourced Fulfillment Promontory Mortgagepath

The Role Of Mortgage Bpo In The Mortgage Industry

The Role Of Mortgage Bpo In The Mortgage Industry

Choose A Partner For Outsourcing Mortgage Processing Requirements

Choose A Partner For Outsourcing Mortgage Processing Requirements

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.