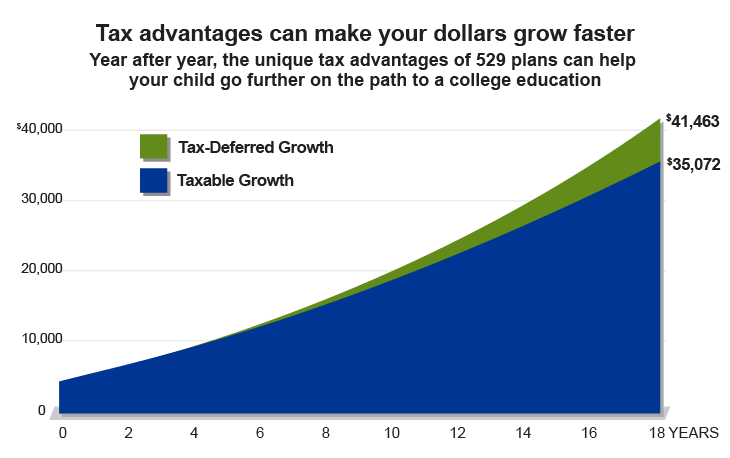

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. A 529 college savings plan allows families to save money for their childs college education in a tax-free investment account.

529 Plans Without The Fossil Fuels Alternative Energy Stocks

Prepaid tuition plans and education savings plans.

Calvert 529 plan. The latest of state-sponsored 529 plans the District of Columbias 529 College Savings Program will allow parents grandparents and others to save for college tuition on a tax-deferred basis. 529 plans legally known as qualified tuition plans are sponsored by states state agencies or educational institutions and are authorized by Section 529 of the Internal Revenue Code. The program was formerly sold nationally through financial advisors and on a load-waived basis to District of Columbia.

The Districts Office of Finance and Treasury will administer the plan. Maryland Prepaid College Trust allows participants to lock in tomorrows tuition at todays prices. The DC College Savings Plan is the Section 529 plan that is sponsored to the Government of the District of Columbia and managed by Calvert Investments.

If the money is. Calvert Equity 529 Portfolio firespringInt 2016-11-10T124521-0600. Contributions to this individual fund portfolio will be invested solely in the Calvert Equity Portfolio Instl.

In November 2017 the Bright Start Advisor-Sold College Savings Program combined with the Illinois Bright Directions Advisor-Guided 529 College Savings Program. There are two different plans available to employees to assist them in saving for college expenses via payroll direct deposit. Before making contributions to this portfolio you should consider the more detailed information about the underlying fund in which it invests including its investment objectives and policies risks and expenses contained in the links below.

In its new role Calvert will act as investment manager and provide the administration and marketing services to the program. For the District of Columbias 529 College Savings Program. Its this extensive experience that allows us to better understand how the pressing challenges facing society today underpin a complex range of both risks and opportunities for the companies in which we invest.

Calvert Research and Management is part of Morgan Stanley Investment Management the asset management division of Morgan Stanley. Ascensus succeeded Calvert Investments as program manager in March 2017. Maryland 529 College Savings plans.

These plans are designed to help you set aside money for your child or grandchild but you can also create one for someone with whom there is no familial relationship. A Blue-Chip Plan Brought to Bronze. 529 college savings plans are the most common type.

Ascensus College Savings Recordkeeping Services LLC ACSR serves as the Program Manager. There are two types of 529 plans. The DC College Savings Plan is a Section 529 plan offered by the Government of the District of Columbia DC.

The Illinois Bright Directions Advisor-Guided 529 College Savings Program sold through brokers and fee-based financial advisors features an extensive multi-manager platform offering a large number of age-based static multi-fund and individual-fund options. The plan features a menu of age-based and static portfolio options utilizing investments from BlackRock Vanguard Loomis Sayles JP Morgan Dimensional Fund Advisors DFA Schwab and Ameritas Life. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

The most popular the tax-advantaged 529 plans have been offered nation-wide for over 20 years. The industrys largest 529 college savings plan Virginias CollegeAmerica joined the roster of Bronze-rated plans this year as did with Illinois Bright. You also may wish to contact directly your home states 529 college savings plans or any other 529 plan to learn more about those plans features benefits and limitations.

Before investing in any Calvert fund prospective investors should consider carefully the investment objectives risks and charges and expenses. There are two types of 529 plans. 529 plan grows tax free and is not taxed by the federal government when you take it out.

But in an effort to. There are flexible payment options and plans to fit your educational needs. The DC College Savings Plan is currently the only 529 plan that offers a full range of SRI options offered by Calvert Investments a well-known socially-conscience provider.

The value of a 529 plan owned by a dependent student or parent is considered a parental asset on the FASFA and will reduce the students aid package by a. Washington DC In the fall of 2002 the Government of the District of Columbia will launch a 529 college savings program designed to help families relatives and friends save money for college expenses. ACSR and its affiliates Ascensus College Savings have overall responsibility for the day-to-day operations including investment advisory recordkeeping and administrative services and marketing.

Investments grow tax-free and can be withdrawn tax-free for educational expenses such as tuition room and. Calvert has been at the forefront of ESG investing for decades focusing on matters related to the Environment Society and corporate Governance.

The Dc College Savings Plan 529 Basics

The Dc College Savings Plan 529 Basics

Calvert Investments Dc 529 Plan Rebrand 529 Plan 529 College Savings Plan Saving For College

Calvert Investments Dc 529 Plan Rebrand 529 Plan 529 College Savings Plan Saving For College

.jpg) 529 Comparison College Savings Plans Network Compare 529 Plans

529 Comparison College Savings Plans Network Compare 529 Plans

Review Of The Overhauled D C College Savings Plan Donalies Financial Planning

District Of Columbia Dc 529 College Savings Plans Saving For College

District Of Columbia Dc 529 College Savings Plans Saving For College

All Dc College Savings Plan Portfolios

All Dc College Savings Plan Portfolios

Calvert Investments Dc 529 Plan Rebrand How To Plan 529 College Savings Plan Saving For College

Calvert Investments Dc 529 Plan Rebrand How To Plan 529 College Savings Plan Saving For College

Bright Directions 529 College Savings Program The Bright

Bright Directions 529 College Savings Program The Bright

529 College Savings Plans Go Green Are Your Investments Environmentally Friendly Thestreet

529 College Savings Plans Go Green Are Your Investments Environmentally Friendly Thestreet

Liz Weston Is It Time To Switch Your College Savings Plan Wtop

Liz Weston Is It Time To Switch Your College Savings Plan Wtop

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.