This can essentially prevent the plan from otherwise lapsing. Non Guaranteed Universal Life Insurance Lapses Conclusion Hopefully this article has provided some insight into the problem and the steps you can take going forward.

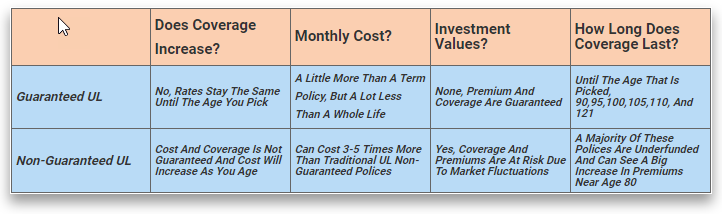

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Tips on choosing a life insurance company.

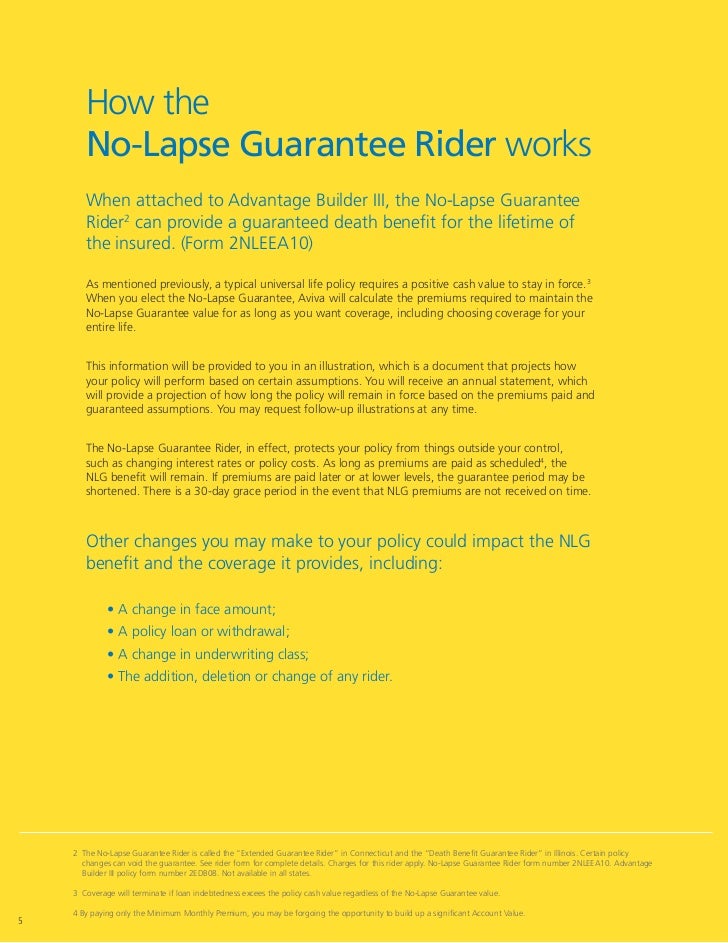

What is no lapse guarantee life insurance. Who should buy a universal life insurance policy with a no-lapse guarantee. Insurance policies that boast this feature have lower premiums than other life insurance products because it has little or. Anyone who wants their life insurance premiums and death benefit guaranteed level for the rest of their lives.

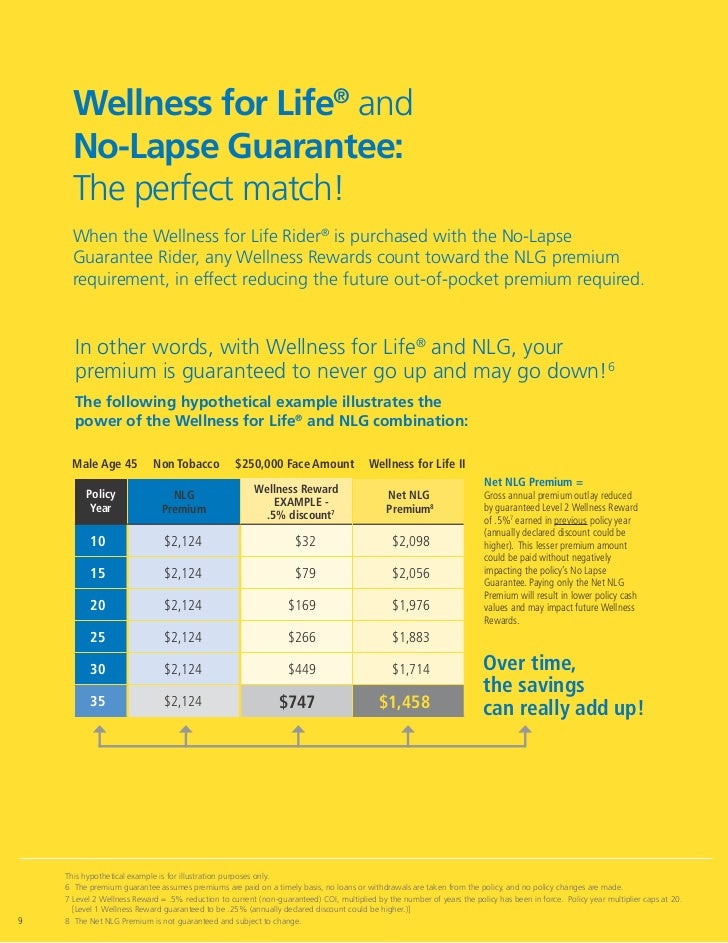

The Extended No-Lapse Guarantee ENLG rider can add an extra measure of security at a low cost. Stay the same amount for your entire life. For permanent life insurance the first and foremost estate planning tool is Guaranteed No-Lapse Universal Life locking in coverage to age 120 or beyond.

It keeps your policy from lapsing regardless of the policys net cash value. The no-lapse guarantee affects the insureds ability to take loans on the policy. What is Nationwide No-Lapse Guarantee UL II.

A no lapse guarantee universal life insurance policy is designed to be a long term insurance solution which is guaranteed to stay in force until a certain age. A lapse means a life insurance policy is no longer an active contract due to missed premium payments. The Lifetime No-Lapse Guarantee Rider form R17LYFNL or ICC17 R17LYFNL based on state of policy issue is included in the policy at no additional charge.

With no-lapse policies everything is guaranteed no matter what the market does. A Guaranteed UL also called no-lapse Universal Life like term has a fixed premium for a set period of time up to an age 120 lifetime guarantee. With a Nationwide No-Lapse Guarantee UL II universal life insurance policy you can establish a lasting legacy for your loved ones.

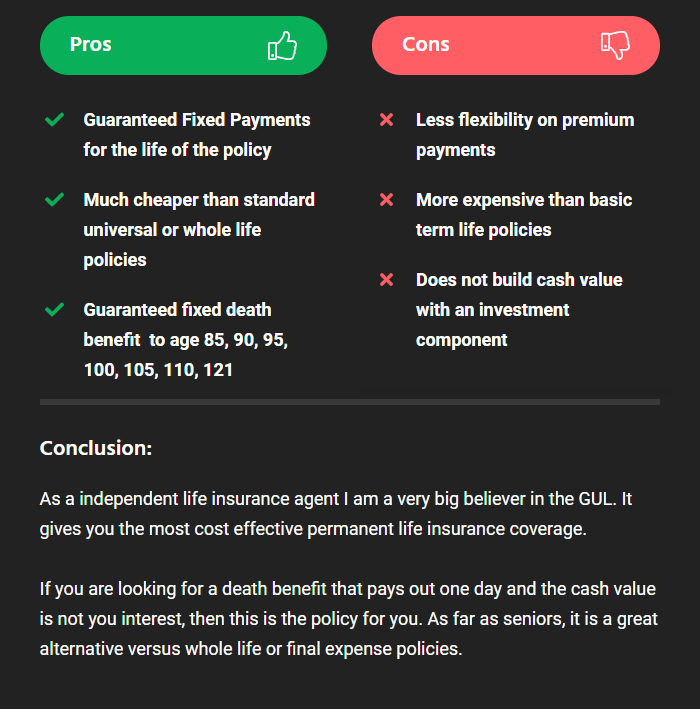

1 Not lapse if the cash value goes to zero so long as you pay your premiums note NLPG policies actually have LESS premium flexibility than universal life policies withOUT themthough I can definitely see how the name might appear to imply otherwise 2 The premium will be level ie. No Lapse Guarantee Universal Life Insurance focuses on guaranteed coverage and death benefit payment throughout your lifetime. A no-lapse guarantee is an agreement as part of a life insurance policy in which the death benefit for the insured is assured.

The no-lapse guarantee depending on how you structure your policy has a maximum duration of the insureds lifetime subject to certain limits. As we mentioned earlier it would be a good idea to consult with an agent. Pay on time and coverage is guaranteed and the premium is guaranteed never to go up.

The term lapse refers to a lapse in coverage meaning the life insurance contract will no longer pay a death benefit or provide. These ages usually range until age 90 all the way to age 120. A no-lapse guarantee provides an agreement by the insurance company to keep a permanent life insurance policy in force even if the cash value in the policy drops to zero or less than zero provided that a specified minimum continuation premium is made at the required time.

Use an independent life insurance. The first issue is that most no-lapse UL policies wont accumulate significant policy value due to the cost of the. Plan financial security for.

Of all the permanent life insurance products Guaranteed Universal Life offers the lowest cost death benefit. For other situations and goals the options include current assumption Universal Life Indexed UL or. You can choose how long you would like to keep your coverage when you apply for your policy.

No-lapse universal life also called guaranteed universal life or universal life with a secondary guarantee is functionally equivalent to term. A No Lapse Guarantee protects you from cancellation in the event that your life insurance policys cash value drops below 0. The No-Lapse Guarantee premium is the amount that must be paid to ensure that the policy will stay in force for a set number of years regardless of actual policy performance.

A life insurance policy will lapse when both premium payments are missed and cash surrender value is exhausted if it is a permanent life insurance policy. What Does No-lapse Guarantee Mean.

No Waste Ul No Lapse Ul Optimized Glenn Daily

Too Expensive It S More Costly Not To Have Life Insurance Llis

Too Expensive It S More Costly Not To Have Life Insurance Llis

Https Cdn2 Hubspot Net Hubfs 1748227 Flm 1162ao 2 Nlg Nlg 20ii 20 Sidebysideone Pager Final Pdf

Aviva Index Universal Life Insurance Crediting Interest To Your Cash

Aviva Index Universal Life Insurance Crediting Interest To Your Cash

Https Cdn2 Hubspot Net Hubfs 1748227 Nlg 20ii 20product 20highlights 20flm 1166ao 1 Nlg Product Highlights Final1 Pdf

Choosing Life Insurance In A Volatile Economic Environment

Choosing Life Insurance In A Volatile Economic Environment

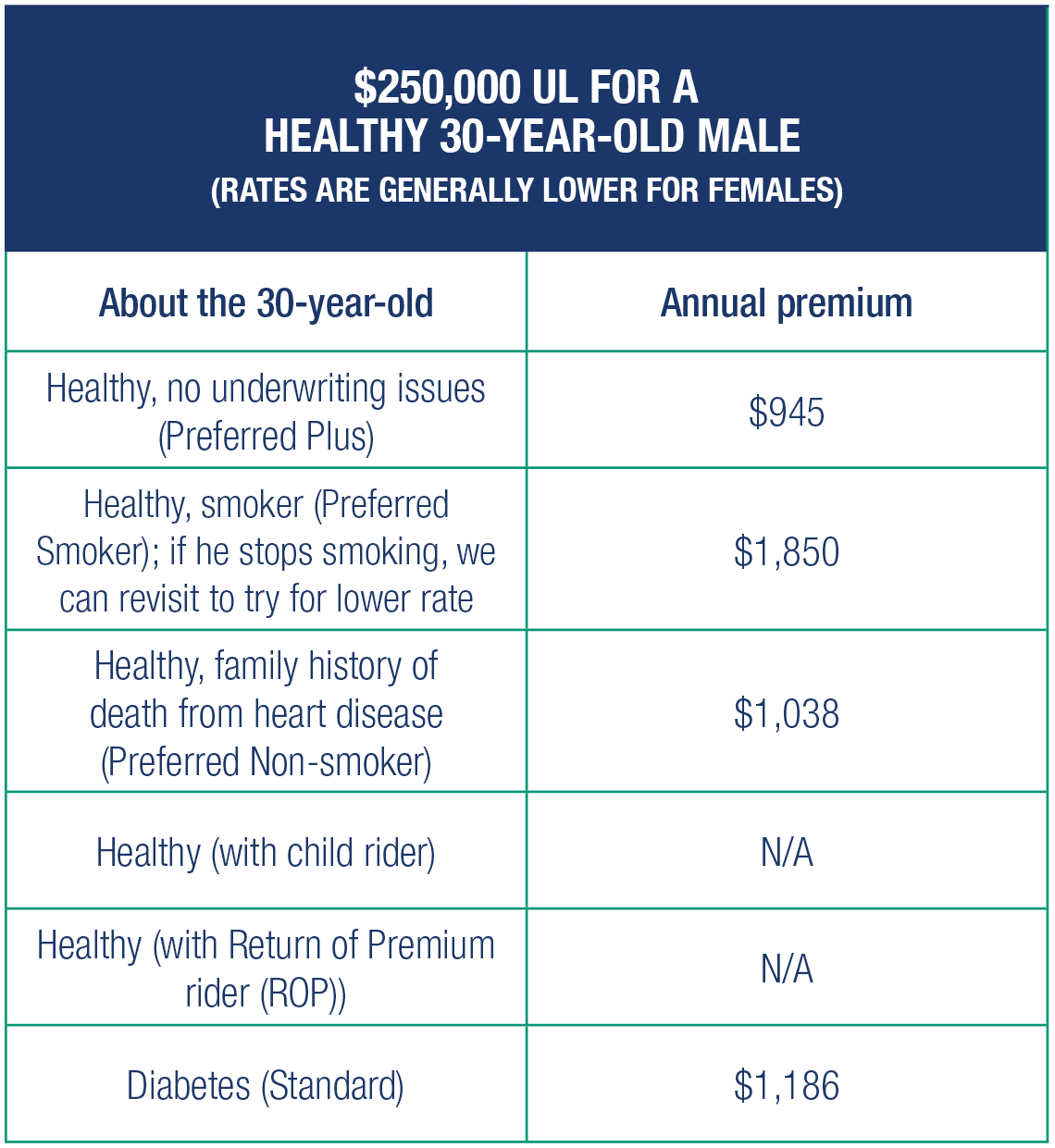

Instant Guaranteed Universal Life Insurance Quotes Policymutual Com

Instant Guaranteed Universal Life Insurance Quotes Policymutual Com

Types Of Universal Life Insurance

Types Of Universal Life Insurance

No Lapse Secondary Guarantee Life Insurance Policies Ali Cle

No Lapse Secondary Guarantee Life Insurance Policies Ali Cle

Aviva Index Universal Life Insurance Crediting Interest To Your Cash

Aviva Index Universal Life Insurance Crediting Interest To Your Cash

Non Guaranteed Vs Guaranteed Universal Life Insurance The Basics

Non Guaranteed Vs Guaranteed Universal Life Insurance The Basics

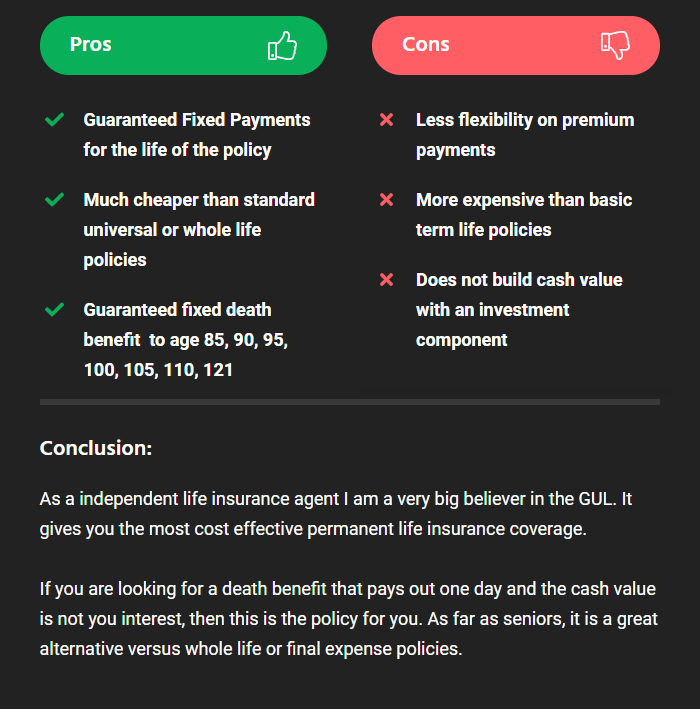

Guaranteed Universal Life Insurance Definition Advantages Disadvantages

Guaranteed Universal Life Insurance Definition Advantages Disadvantages

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.