With a Roth IRA you dont get. Open a Roth IRA for Kids.

Why Your Kid Needs A Roth Ira Nerdwallet

Why Your Kid Needs A Roth Ira Nerdwallet

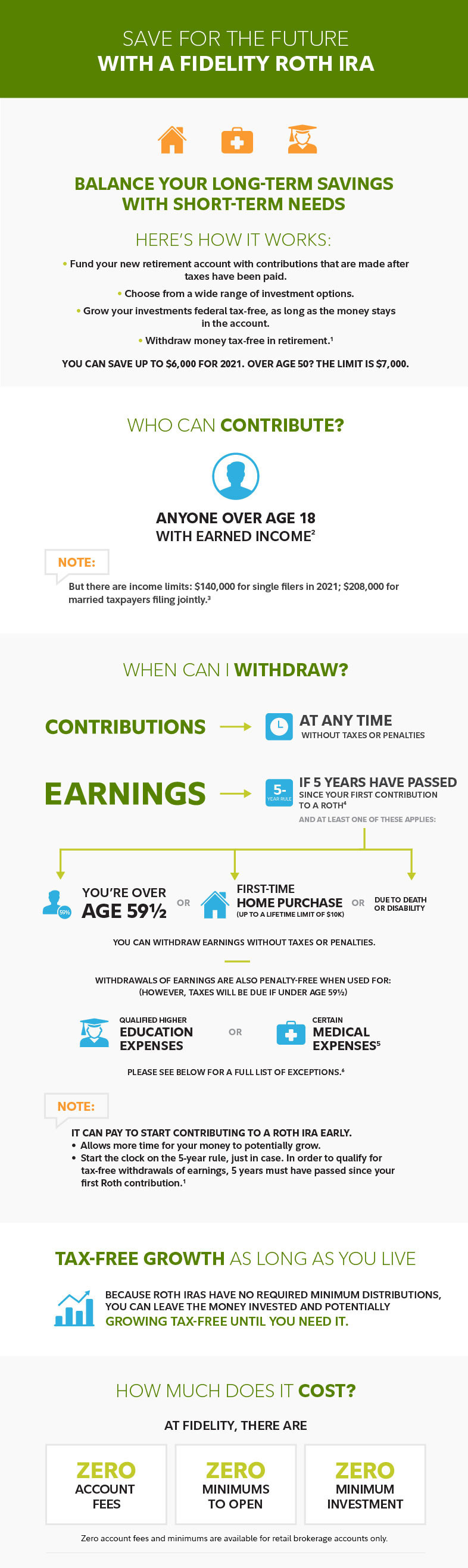

A Roth IRA for Kids provides all the benefits of a regular Roth IRA but is geared toward children under the age of 18.

Fidelity open roth ira for child. 16 Zeilen Roth IRA for Kids Attainable Savings Plan ABLE Suited for. Like Fidelity Schwab does not have account. But you want to click on All Accounts to get to Roth IRA for kids.

We recommend Fidelity since they appear to have a dedicated page for Roth IRAs for kids and they have no. Youre going to have more bonds which gives you a lot more security and also much less in supplies. Not all banks offer custodial IRAs but two that do are Fidelitys Roth IRA for Kids and Charles Schwabs Schwab One Custodial Account.

Target-Date funds immediately select a blend of investments for you based upon your. Clicking on that takes you to this list of the most commonly opened accounts with them. Basically a childs Roth IRA is one that you act as custodian for.

Open an Account This is Fidelitys Homepage and the Open An Account tab is right on top. Children under the age of 18 need a custodial Roth IRA. For getting an early start on the childs retirement savings consider a Roth IRA for Kids For greater flexibility transferring money at an age you choose generally up to 35 consider a trust through our Personal Trust Services Our brokerage accounts include everything Fidelity has to offer.

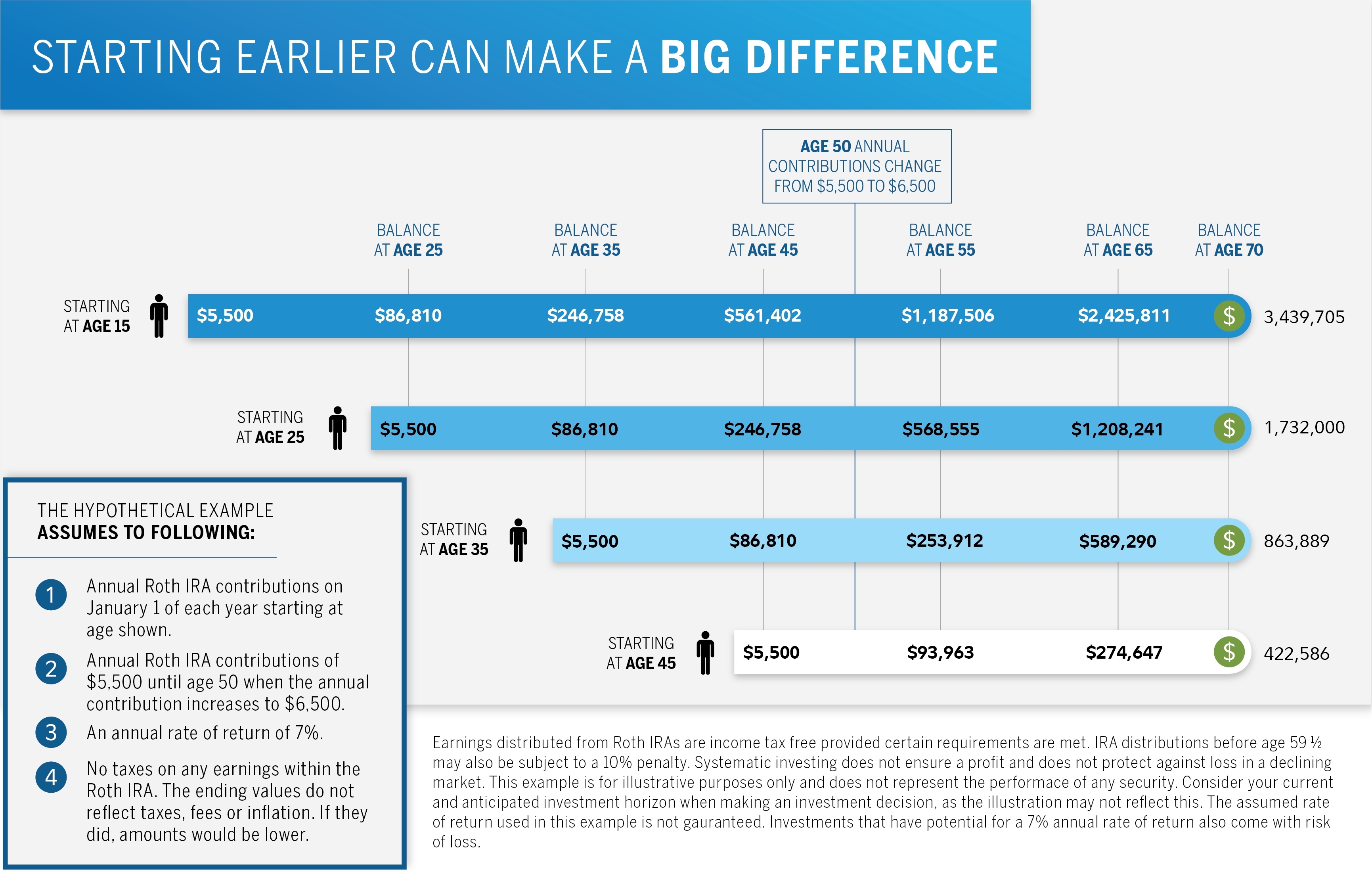

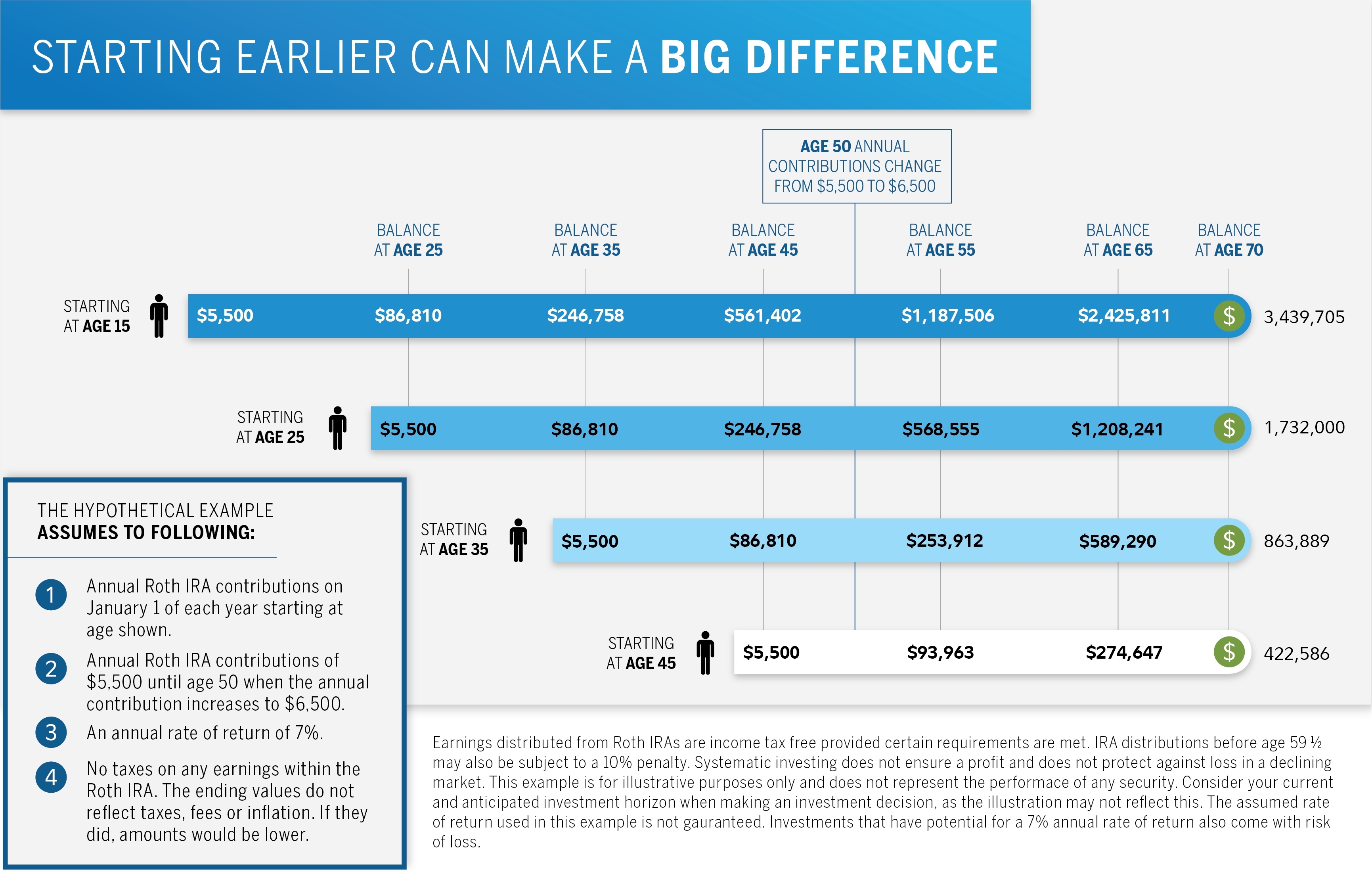

Starting early could be your childs advantage Lets say you open a Roth IRA for your 13-year-old who works as a babysitter or mows lawns. Determine Your Roth IRA Eligibility. For 2021 the maximum your child can contribute to an IRA either traditional or Roth is the lesser of 6000 or their taxable earnings for the year.

One way to do that is to establish a custodial account Roth IRA or what is known at Fidelity as a Roth IRA for Kids and more generally as a Roth IRA for minors. If your adult child is eligible but not contributing because of lack of funds or just not concerned about saving for retirement you can give him or her the money each year. Charles Schwab also has a dedicated page for Custodial IRAs.

The maximum Child Tax Credit in 2021 to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. Frequently Asked Questions About Opening a Roth IRA. Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

Fund Your Roth IRA and Set a Contribution Schedule. 10 For example if your youngest child. Tax-Free Growth and Income for Retirement One of the biggest perks of a Roth IRA is the tax break it offers.

You can also give someone a Roth IRA by designating them as your account beneficiary. However as long as your kid meets eligibility requirements. That means theyll own the account but as the childs parent youll make the investment decisions until they reach the age of majority which is between 18 and 21 depending on the state.

But since an IRA is an INDIVIDUAL retirement account he or she would have to open his own account perhaps at Fidelity or Vanguard and make the investment. Fidelity Roth IRA for Kids. Its called a 2025 fund since if youre intending to retire truly quickly you dont have the high-end of waiting on a recuperation in case of a stock market downturn.

You may need to serve as custodian of the account until your child turns 18 as brokerages generally dont allow minors to open their own accounts. At least one broker Fidelity has introduced a. Open Your Roth IRA Account Online.

You can give a child a Roth by establishing an account in their name and helping to fund it. Theres usually no minimum amount required to open a childs IRA or Roth IRA account but certain investments may require a minimum initial investment. Because your child is a minor they cant open their own account.

Once they reach the age of majority theyre in control of the money. This account can be opened and managed by any adultparent grandparent aunt uncle family friendon behalf of a minor earning income. Fidelity open Roth IRA for child.

Fidelity Roth IRA for Kids Help a child invest for the future. Where to Open a Roth IRA for Children Fidelity. Choose a Company To Oversee Your Roth IRA.

Then it will be reported on hisher tax return especially if. Invest the Money in Your Roth IRA Account. Why Open a Roth IRA.

Youll need to open a custodial Roth IRA for a minor child. Minors cannot generally open brokerage accounts in their own name until they are 18 so a Roth IRA for Kids.

Fidelity Investments On Twitter Do Your Kids Work In The Summer Help Jump Start Their Retirement Savings With A Roth Ira For Kids Https T Co T4elmxuxdc Https T Co I6p5fn45g0

Fidelity Investments On Twitter Do Your Kids Work In The Summer Help Jump Start Their Retirement Savings With A Roth Ira For Kids Https T Co T4elmxuxdc Https T Co I6p5fn45g0

Ira Transfer Moving Your Ira Fidelity

Ira Transfer Moving Your Ira Fidelity

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

Fidelity Ira Fees Roth Retirement Account Cost 2021

Fidelity Ira Fees Roth Retirement Account Cost 2021

How To Open A Roth Ira For Kids Physician Finance Basics

How To Open A Roth Ira For Kids Physician Finance Basics

How To Open A Roth Ira For Kids Physician Finance Basics

How To Open A Roth Ira For Kids Physician Finance Basics

Roth Vs Traditional Ira Infographic Fidelity

Roth Vs Traditional Ira Infographic Fidelity

How To Open A Roth Ira For Kids Physician Finance Basics

How To Open A Roth Ira For Kids Physician Finance Basics

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

How To Open A Roth Ira For Kids Physician Finance Basics

How To Open A Roth Ira For Kids Physician Finance Basics

Roth Ira Saving For Your Future Fidelity

Roth Ira Saving For Your Future Fidelity

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.