TD Ameritrade wins another category. The fees are part of the spread.

E Trade S Future Is Clouded By Schwab Td Ameritrade Deal Wsj

E Trade S Future Is Clouded By Schwab Td Ameritrade Deal Wsj

To help people realize their financial dreams through investing.

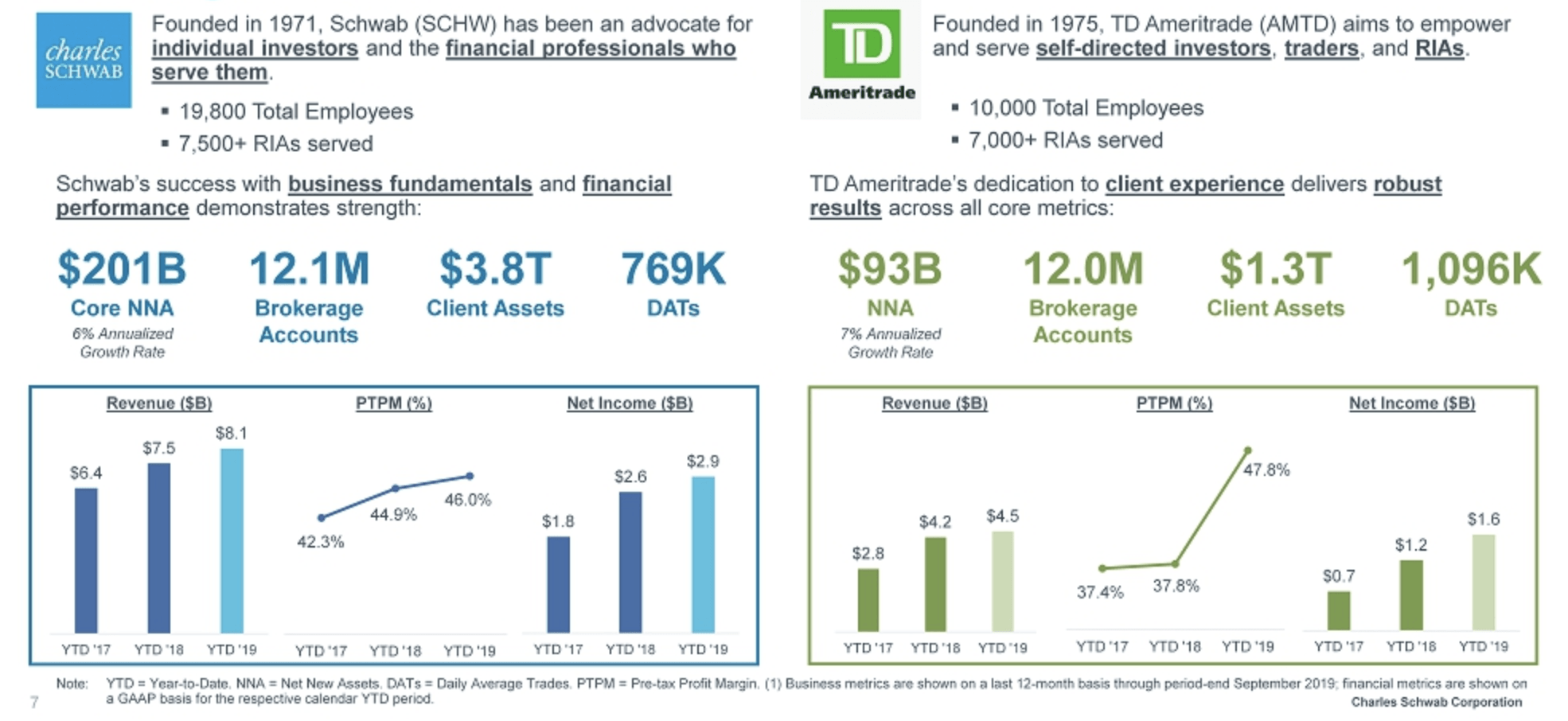

Schwab vs ameritrade. Its flagship Schwab platform as well as StreetSmart for sophisticated investors. Charles Schwab vs. TD Ameritrade and Schwab are now part of one company with a shared mission.

There is no minimum deposit no maintenance fee and no inactivity fee. Compared to TD Ameritrade who provides brokerage services for individuals and institutions to invest online. 0 1995 065 per contract 0 0 Vanguard.

While TD Ameritrade offers 0 commission online stock ETF and option trades. Fidelity has a minimum opening requirement of 2500 while ETrade requires at least 500 and TD Ameritrade and. The biggest difference is that Schwab has its own FDIC-insured bank TD Ameritrade is an independent company with TD Bank as its largest shareholder.

Technically this is a securities account without margin. Charles Schwab vs. Ally Invest is the cheapest for mutual fund investors with low 10 per transaction rate for transaction-fee no-load mutual funds.

After testing 11 of the best online brokers over three months TD Ameritrade 100 is better than Charles Schwab 9587. Charles Schwab offers stock and ETF trades at 0 commission and options trading at 0 commission 065 per contract. Together we have nearly a century of investing experience and a proven record of pushing the industry forward for investors and traders.

Moving on Charles Schwab is also a US-based trading platform that was launched in 1971 and is listed on the NYSE New York Stock Exchange under the ticker symbol SCHW. Arguably the only significant difference is that Ameritrade charges 225 per contract to trade futures while Schwab charges 150. Today were going to dive into the details to help you decide which is a better fit for your money.

On Schwabs website we found calculators articles and videos on a range of issues. Schwab and Ameritrade both offer website and app-based trading options. The maximum timeframe is 35 years 15 more years than Schwab delivers.

0 4995 065 per contract 0 0 Etrade. Fidelity offers something called the Cash Management Account. All pricing data was obtained from a published web site as of 01192021 and is believed to be accurate but is not guaranteed.

This online broker also has more than 100 branch locations. Charles Schwab offers investors a complete suite of products and services with excellent stock research quality trade tools and professional planning. Schwab requires a minimum of 1000 to open an account this obligation can be waived by opening a Schwab checking account during the application process.

Unlike Charles Schwab TD Ameritrade supports forex trading with low forex fees. TD Ameritrade and Schwab both appeal to a wide range of investment needs while Tastyworks is a more niche offering for active traders. Schwab offers an FDIC-insured checking account whereas TD Ameritrade simply attaches checks and a Visa card to a pre-existing brokerage account.

Research Education If youre not quite familiar with all aspects of the investment world both brokerage houses have you covered. TD Ameritrade delivers 0 trades fantastic trading platforms excellent market research industry-leading education for beginners and reliable customer service. Ameritrade also offers two trading options.

They have everything from stocks and options trading to fixed income and retirement guidance. But that doesnt mean you should overlook the trading tools offered by TD Ameritrade or Schwab. In addition to its flagship Ameritrade platform the firm offers thinkorswim.

Schwab brokerage clients who need cash management tools can open a checking account that comes with free checks and a Visa debit card. 0 4999 065 per contract 0 0 Fidelity. As noted above Schwab offers two different brands.

TD Ameritrade is a toss-up thats going to land you with a great stock broker no matter which one you choose. TD Ameritrade Schwab and Ally Invest are charging 0 per trade for stocks and ETFs which is below the average in the industry. 0 4995 065 per contract 0 0 Charles Schwab.

The average spread cost is 12 pips during trading hours. For stock trade rates advertised pricing is for a standard order size of 500 shares of stock priced at 30. 0 20 100 per contract 20 20.

Td Ameritrade And Best Canabis Stock Schwab Free Trade Etf List

Td Ameritrade And Best Canabis Stock Schwab Free Trade Etf List

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade Vs Charles Schwab 2021

/CharlesSchwabvs.TDAmeritrade-5c61bb24c9e77c00010a4e01.png) Charles Schwab Vs Td Ameritrade

Charles Schwab Vs Td Ameritrade

Td Ameritrade Charles Schwab What To Know Td Ameritrade

Td Ameritrade Charles Schwab What To Know Td Ameritrade

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade Vs Charles Schwab 2021

Charles Schwab Vs Td Ameritrade Comparison Investormint

Charles Schwab Vs Td Ameritrade Comparison Investormint

Td Ameritrade Vs Charles Schwab Pros Cons Compare Benzinga

Td Ameritrade Vs Charles Schwab Pros Cons Compare Benzinga

Charles Schwab Vs Td Ameritrade The Entrepreneur Fund

Charles Schwab Vs Td Ameritrade The Entrepreneur Fund

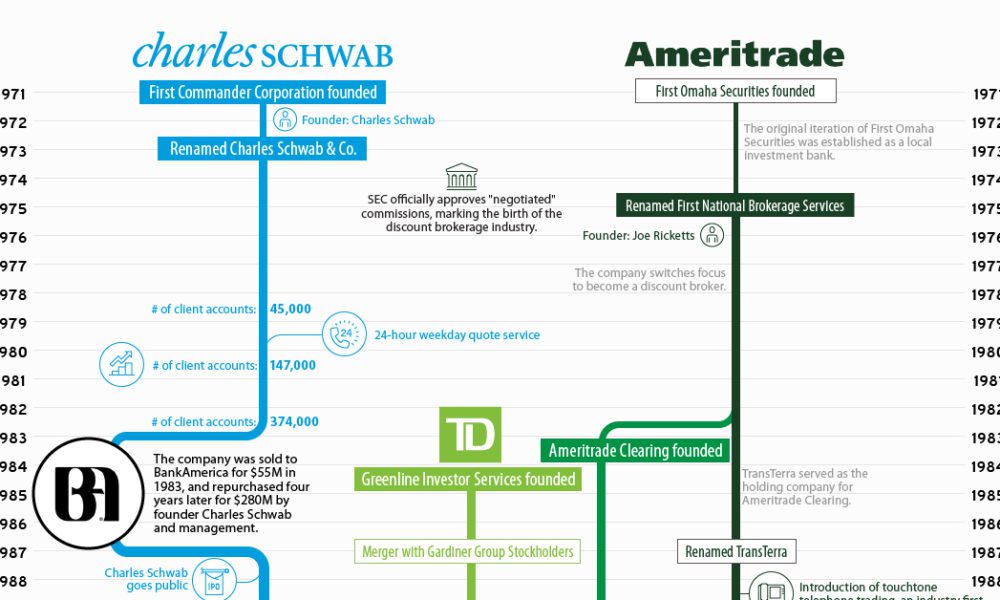

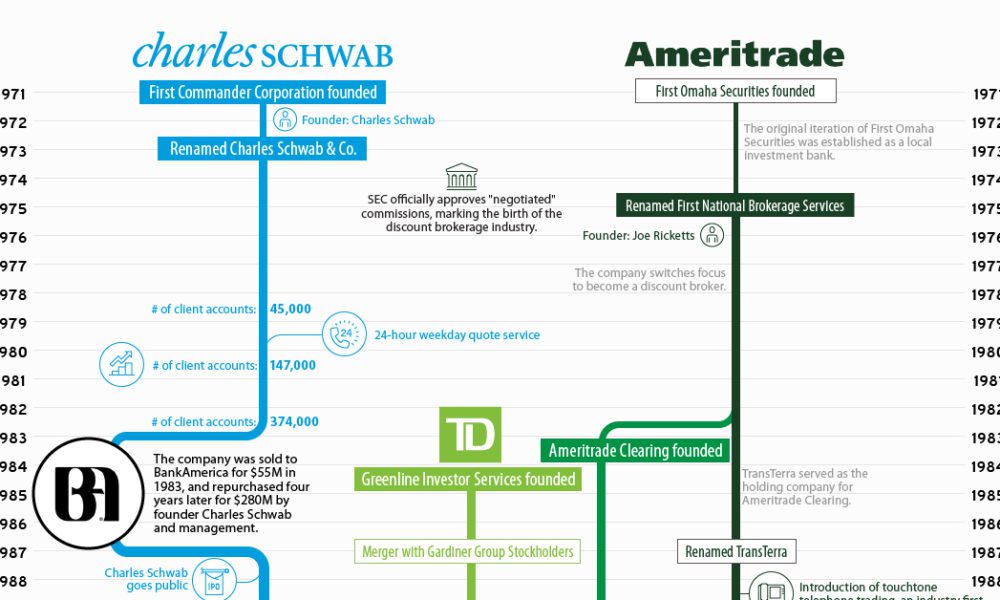

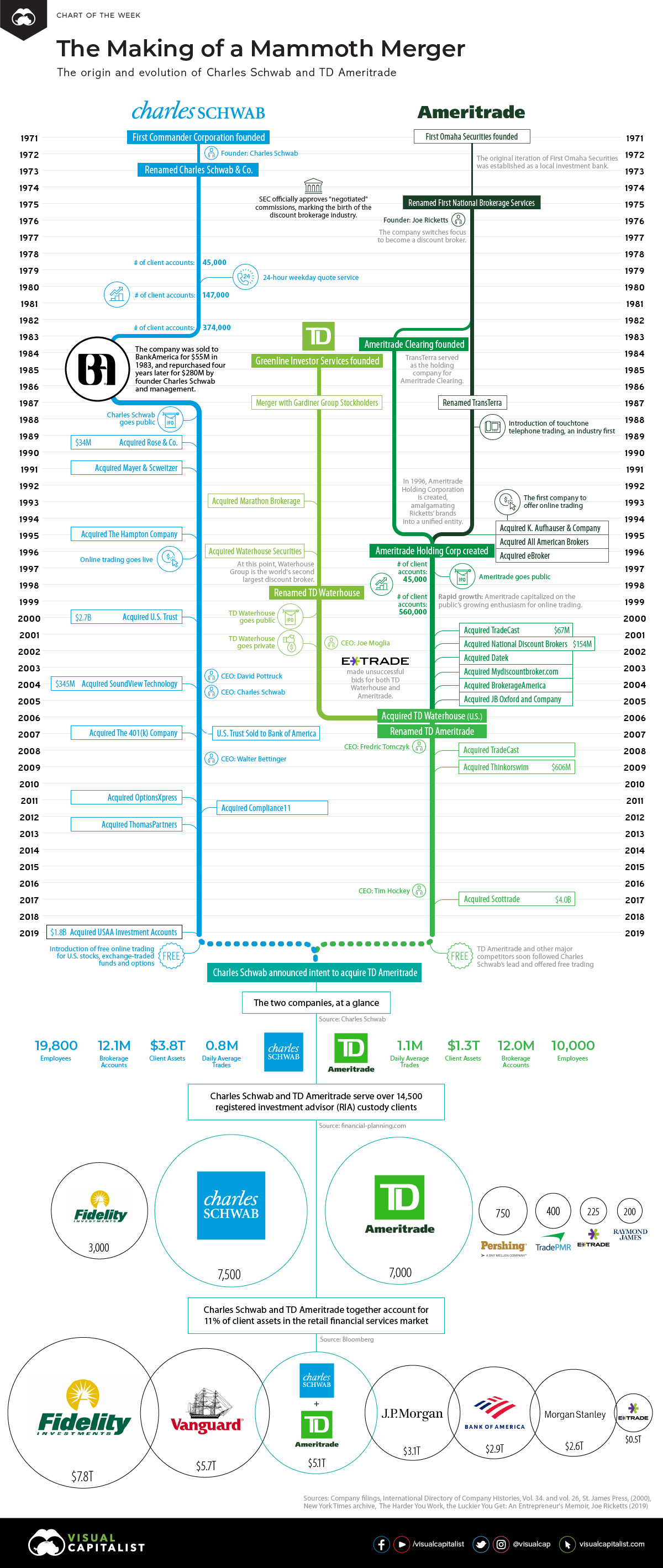

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

Charles Schwab Vs Td Ameritrade Which Is Better

Charles Schwab Vs Td Ameritrade Which Is Better

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

Charles Schwab Vs Td Ameritrade Brokerage Review Youtube

Charles Schwab Vs Td Ameritrade Brokerage Review Youtube

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade Vs Charles Schwab 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.